1. Pricing & Buying

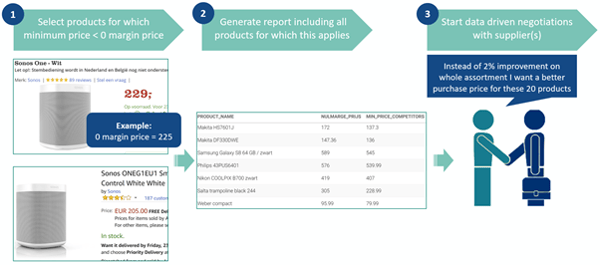

In a lot of organizations buyers will have supplier negotiations once or twice a year. Traditionally, a buyer would aim for a few percent purchase price improvement on the complete assortment they offer. With the increased frequency of price changes and price transparency, this traditional set-up of the buying process has two cons:

1. The purchase price improvement % or amount

a. Traditional situation: without access to pricing data, a buyer would aim for the highest % as possible

b. Ideal situation: data-driven % or amount per product based on lowest price in the market instead of a random number

2. Frequency

a. Traditional situation: negotiations once or twice a year

b. Ideal situation: frequency of negotiations in line with pricing dynamics of the market (e.g. daily or weekly)

In Omnia, both cons can be solved quite easily by setting up a report. This report contains all products for which the minimum price in the market is below your zero margin price (e.g. you’re not able to match that price due to your purchase price), can be sent daily or weekly to the buyer’s e-mail (or directly to the supplier) and this can be used to start data-driven negotiations with suppliers.

2. Pricing & Supply chain

We typically see that most retailers do not take price position per product into consideration when deciding what and how many products to stock. This is not because they not want to, but due to lack of data. Usually, first, a buyer decides what products to buy. At that moment it would be helpful to know your price position per product (e.g. will it be competitive), as it enables supply chain to give a more accurate estimate of how many products you will approximately sell. In Omnia, you can easily set-up a report that shows price position per product, which can be used as additional input for supply chain. This report can, for example, show an alert that advises negotiating a better purchase price before you take it on stock.

Once you have a product on stock, it might happen that competitors decrease their price and you’re not competitive anymore. In Omnia, you can set-up a report that shows products with a lot of views but low conversion, which might be due to the price position. This report can be used by:

- Buyers; to get compensation for those products

- Supply chain; so they won’t order those products until the buyers managed to get compensation

3. Pricing & Marketing

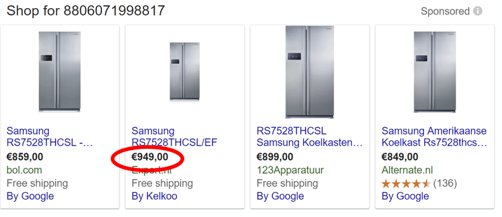

In large corporates, we typically see that the marketing department, who decides what products to advertise and what advertising budget will be allocated per product, do not communicate with the pricing department, who know the margin and the price position of those products. Without access to price position data, marketers might spend advertising money to show they are outpriced versus competition. Those ads obviously result in low conversion rates and negative price perception.

In order to avoid this Omnia enables clients to incorporate pricing data in bid calculation, thereby enabling them to for example exclude products to marketing channels for which their price is more than 20% above the competitor average price or decrease the bid when price position is greater than position 5. Read this blog to learn more about the added value of using pricing data as structured input for online marketing decisions.

To conclude

Every business that offers branded products, offered by more than one retailer, needs pricing input for both buying as well as marketing decisions. Therefore, there should be communication (e.g. share data insights) between the people who are responsible for pricing, buying, marketing, and supply chain in an organization. By sharing those pricing insights on a frequent basis, the pricing data potential could be fully exploited by using it as structured input for buying, supply chain, and marketing decisions. Omnia enables retailers to automate this communication process through the set-up of reports and built-in features to use price position in bid calculations for marketing campaigns.

In case you’d like to learn more about what Omnia’s software could offer for you, request more information or a demo here or give us a call at +31 (0) 85 047 92 40.

.png?height=766&name=ORA%20Visuals%2020252026%20(11).png)