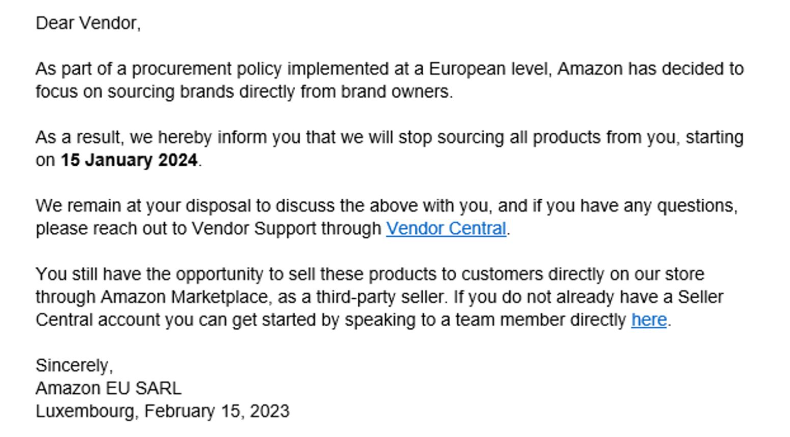

In a bid to increase annual profits, Amazon is actively severing its relationships with third-party sellers. From 15 January 2024, as an email from Amazon to third-party sellers suggests, the e-commerce authoritarian will be pursuing partnerships with brands directly, squeezing brand owners out of their relationship with distributors if they want to remain on the online marketplace.

Source: Consulterce - LinkedIn

Amazon has experienced a downturn in sales and ad revenue from merchants in 2022, compared to the pandemic years of 2020 and 2021. “Amazon is trying to increase profit margins in its retail division at all costs right now,” says Martin Heubal, a strategy consultant who used to work for the tech giant and who helps Amazon vendors achieve growth on the platform. Bloomberg News reports that the platform’s advertising sales growth was shaky all throughout 2022, which affected its profit margins. In addition, Amazon’s sales growth was at its slowest over this period, resulting in new strategies to increase profits. Other game plans to boost profits include the recent layoffs of 18,000 employees, which is the largest in the company’s history. In addition, it was announced in early January that three warehouses in the UK would be closed down as a part of their downsizing procedures.

What’s the impact on brands and distributors?

Amazon suggests this new procurement strategy is to cut out the middleman and lower costs for consumers, however, this strategy suggests a broadening of the monopoly they have within online retail to force brands to choose between growth and profit with the marketplace or moving with their distributor who is being cut out. In the US, 40% of all online shopping is done on Amazon, which means 40 cents of every dollar a consumer spends is shopped on Amazon. Many brands may find that because of this grasp on consumer spending power, they may have to choose to do business directly with them, leaving their partnerships with distributors null and void.

To add salt to an open wound, their business models and distribution strategies will be turned on their heads, while third-party sellers struggle to stay buoyant. In the same email, Amazon said distributors can still sell these products directly to customers on Marketplace, however, this will require price changes that will affect both the distributor and the consumer. Typically, distributors sell in bulk at a lower price, which benefits all parties. By having to move from B2B to D2C, a distributor will have to factor in new costs and strategies.

Talk to one of our consultants about dynamic pricing.

As 15 January 2024 approaches, brands have tough decisions to make

As we know, 1P (first-party) brands lose many commercial freedoms when selling on the marketplace such as price setting. As we have seen in the past, once Amazon gains market share within a vertical and control of the client, they can dictate a price. So, is this a good move, long-term, for consumers and brands? Alternatively, if brands have other D2C channels, are they enough to maintain the same profit margins?

Omnia’s Founder and CEO, Sander Roose, shared that the larger problem is this decision by Amazon will create many complexities for brands. “All of a sudden, brands will have new things to learn and new decisions to make. For example, how will the working relationship play out with Amazon after years of having longstanding relationships with their distributors? Should they sell 1P or 3P? How, and to what extent, should they use Amazon ads to fuel sales? What will the process be when Amazon starts making changes or demands about prices or inventory? This, I believe, is the main setback for those brands.”

.png?height=766&name=ORA%20Visuals%2020252026%20(11).png)