We live in a world of endless choice, and while the number of options can be exciting for shoppers, it can also be overwhelming. Comparison shopping engines (CSEs) have emerged as a valuable tool for shoppers to make informed purchase decisions and for e-commerce brands and retailers to increase online visibility and sales.

But CSEs are not all the same; some, like Google Shopping, are huge generalist sites covering any product you can think of, while others are vertical shopping sites focused on specific categories. The most popular sites also vary by country, and each population uses them differently.

In this post, Omnia discusses what consumers use comparison shopping engines for, the top sites by country, some benefits and challenges of selling on CSEs, and what we expect to see in the future.

Consumers use comparison shopping engines to reduce choice overwhelm and find the best price

As our global economy continues to accelerate, consumers are faced with an increasing number of choices and opportunities. This means that many consumers are overwhelmed by too many offers that they have difficulty evaluating. This is how CSEs first appeared in the 1990s: influential digital institutions wanted to create a solution that would keep internet users in contact with available products, assisting the shopper in making a purchase while reducing confusion and overwhelm.

Comparison shopping engines have now become a significant piece of the tool belt for e-commerce businesses looking to increase their online visibility and boost sales by going head-to-head against the competition. CSEs allow customers to quickly view different products from multiple vendors, compare features and prices, and make informed decisions about what to buy.

CSEs are often some of the highest ranking websites in their respective regions, and for brands and retailers selling on CSEs, the sites can increase visibility among shoppers who may not have otherwise found the business or products through other marketing methods. With Google, for example, Google Shopping results and ads appear either above the search results or on the right side of the page, guaranteeing users will see the products first.

What consumers want out of a CSE

One study cited in the International Journal of Advanced Computer Science and Applications asked respondents to define which characteristics of a CSE would determine its quality:

- 81% wanted the CSE to find a lower price offer

- 80.2% wanted the CSE to be easy to use

- 76.8% wanted the CSE to be accurate in finding the right offer

- 70.2% wanted to have access to additional information about the offer and/or supplier

- 58.7% wanted the CSE to also have ratings, comments, and evaluations from other buyers

That first statistic is consistent with other studies and the conventional wisdom that CSEs are used first and foremost to find the best price, which makes sense considering that they are also referred to as “price comparison websites”

CSEs are used across the world, but the most popular sites and categories vary

No matter the country, there are shoppers looking for the best deal, so CSEs have a worldwide presence. Some of the most popular CSEs in European markets include:

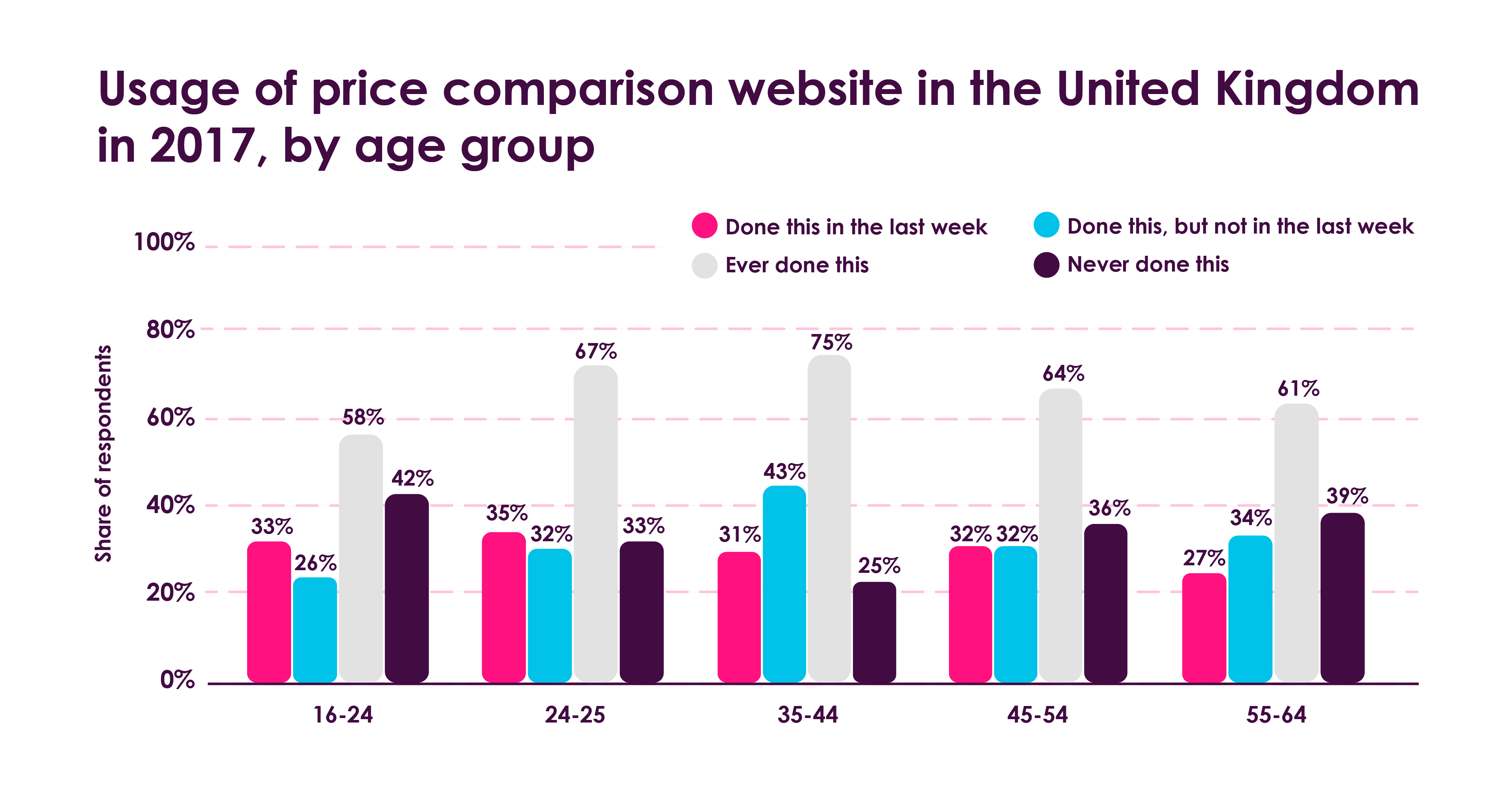

How CSEs are used varies by location, age group, income level, and other factors. In a study in the UK, for example, shoppers in the 35-44 age range were the most likely group to have used a price comparison website, with 75% saying they had shopped on a CSE before.

Source: Statista

CSE comparison: Google Shopping and Amazon

Google’s CSE arm is Google Shopping, and it’s one of the biggest comparison sites worldwide. Users shop across the platform more than 1 billion times per day, with 36% of all product searches originating on the site. Meanwhile, 49% of all product searches originate on Amazon, which has more than 1.7 million sellers for shoppers to compare.

There is a key difference between the two, however, since Amazon is a marketplace. While marketplaces may include some comparison features, such as filters and sorting options, they are not primarily designed to be comparison engines. Amazon has a vested interest in getting customers to the checkout button or, even better, buying their own branded products on the site. Google sees its role differently: In 2021, Google Commerce President Bill Ready said the following on a podcast:

“We’re not a retailer, we’re not a marketplace… What we do want to do is make sure that on a Google surface, the user can discover the best products, the best values, the best sellers, and then seamlessly connect to those sellers. Most of the time, that actually means clicking out to that seller’s own website; it is not our goal to necessarily keep the user on our platform.”

This is interesting to note for brands and retailers selling on either site, and other CSEs in general, as it indicates the key differences between the goals of the platforms themselves. While any CSE will still monetise the process through ads, transaction fees, or other channels, some such as Google may not take on as much of the responsibility of getting the shopper all the way to the purchase point. Because of this, Google Shopping may be a unique case that does not fit perfectly into either the marketplace or CSE bucket.

Benefits and challenges of selling on CSEs

While each comparison shopping engine comes with its own pros and cons for brands and retailers, some of the key benefits and challenges to consider are consistent across platforms:

Benefits:

- Expanded visibility: Listing products on CSEs enables retailers and brands to increase their visibility to potential customers who are actively searching for products.

- Improved conversion rates: CSEs often attract customers who are further along in the purchase process, meaning that they are more likely to convert into buyers.

- Increased sales: As a result of the increased visibility and improved conversion rates, retailers and brands may see an increase in sales.

- Cost-effective advertising: Unlike other forms of advertising, CSEs often operate on a cost-per-click (CPC) model, which means that retailers and brands only pay when someone clicks on their listing.

Challenges:

- Increased competition: CSEs are highly competitive marketplaces, with many retailers and brands vying for the attention of shoppers. If some competitors with the same product offer are out of stock, have fewer or worse reviews, or have different delivery options, then the ones leading in these areas can win the best position on the CSE. Those products will be more likely to be chosen by consumers who care about the quality and trustworthiness of the offer.

- Cost: While CSEs can be cost-effective, the CPC model can quickly add up, especially for smaller retailers and brands with limited marketing budgets.

- Product data management: Retailers and brands must provide accurate and up-to-date product data to CSEs, including pricing, availability, delivery options and product descriptions. This can be time-consuming and requires ongoing maintenance.

- Limited control: CSEs can have their own guidelines around product data, and retailers and brands may have limited control over how their products are presented on the platform.

One interesting factor that can be both a benefit and a challenge is consumer trust, as it is dependent on the reputation of the specific CSE in general or in a particular market. In the UK, for example, a government study found that while most consumers trusted CSEs at least a fair amount across most measures, trust levels were much lower in two key areas:

- Half of consumers did not trust CSEs to ensure data is not shared with third parties without permission

- Four in ten did not trust CSEs to treat all suppliers equally

On the other hand, some comparison sites have built up a high level of trust in their markets. Check24, for example, has been operating since 1999 and is highly trusted in Germany.

Price is not the only competition factor on CSEs

While price is the determining factor of a product’s visibility on a comparison search engine, vendors will not only compete on who has the cheapest price. As we explored earlier, there are other factors that influence the quality and trustworthiness of an offer for consumers.

When developing pricing for CSEs, sellers should consider the following factors in their strategies:

1) Filters

Sellers should filter who they would like to compare product offers with and who they will adjust prices in relation to. Not every competitor will be as important to each seller; for example, even if a seller has a very competitive price, if they are a small retailer or a newcomer with an unknown name and no reviews, they won’t appear to be as trustworthy to a consumer compared to a well-known retailer the consumer trusts for fast and secure delivery. The seller may want to skip adjusting prices to these companies.

2) Market knowledge

It’s important for sellers to know their market and differentiate pricing strategies between assortments and categories. For example, if you sell sporting t-shirts and sporting shoes, each market and product may have a different set of competitors, so a market analysis will be a crucial starting point.

3) Timing of price adjustments

If you adjust your prices in the morning at 8am and your competitor(s) adjust theirs at 9am, then your offer will already be outdated after an hour. You can learn this through market observation, which is made simpler with Omnia’s data.

4) Price elasticity

Price elasticity tends to be quite high on CSEs, so be aware and, if possible, analyse data for the platform to build the right pricing strategy for your products. Omnia has a feature in place to calculate price elasticity, as well as a process for elasticity accuracy in our software.

5) Seasonality

Any seasonal factors that impact your product assortment should be taken into account when setting a pricing strategy. Special sales events like Black Friday will start with a pricing strategy weeks before, while also seeing increased competition. The same goes for Christmas shopping, when sellers need to keep delivery dates in mind for shoppers who want their products by Christmas eve, and how prices might change along with this.

Seasonality shapes consumer behaviour and shopping needs throughout the year, so it is a good idea to have important dates and periods prepared for the whole assortment.

6) Channel alignment

Aligning the offers you provide on the CSE with all other sales channels will be important for consistency. Considering the specific conditions of each marketplace and CSE in price calculations will lead to different prices. However, having automation and an overall pricing strategy, with rules such as rounding to a particular digit, will help properly represent the vendor in the market and easily master all different channels.

The future of comparison shopping: Where do CSEs go next?

With the world of e-commerce changing so rapidly, what can we expect of comparison shopping in the future?

- Increased use of AI and Machine Learning: Comparison shopping engines will increasingly leverage artificial intelligence (AI) and Machine Learning to provide more personalised and targeted search results to shoppers. This will result in more accurate product recommendations and better user experiences.

- Deeper integration with social media: Comparison shopping engines may integrate more deeply with social media platforms such as Instagram and TikTok to allow shoppers to make purchases directly from these platforms. This could result in an increase in impulse purchases and a greater focus on social media marketing for retailers.

- More focus on the changing customer experience: CSEs will need to continually adapt to provide a seamless, up-to-date customer experience. This could include developing mobile-specific features and interfaces, such as voice-activated search and augmented reality shopping, as well as loyalty programs or new payment models.

- Shifting competition: CSEs will face new types of competition as brands and retailers rethink their own selling models. Will more brands choose to sell D2C? Will retailers use their own experience selling branded products on marketplaces to produce their own labels? As costs rise amid inflation and other world events, retailers and brands will look for alternatives to increase profits, which may create competition for marketplaces from new angles.

- Greater emphasis on sustainability: As consumers become more environmentally conscious, comparison shopping engines may need to emphasise sustainability in their search results. This could include highlighting products with eco-friendly certifications or partnering with brands that prioritise sustainability.

- Growing regulatory attention: Comparison shopping engines may face increased scrutiny from governments, particularly in the areas of data privacy and antitrust. This could result in greater transparency requirements for the engines and stricter rules around data collection and use.