Living beings are not the only ones impacted by the circle of life; products have their own version, from birth (introduction) to death (decline) in the market. The Product Life Cycle (PLC) does not just happen to companies, however; it can be used to their benefit when pricing is strategically aligned with the different stages of a product’s life cycle. In this article, Omnia explores the typical brand pricing mentality and how those brands, especially ones using the D2C channel, can strategically price products based on their life cycle.

D2C pricing strategies of brands and retailers

Many brands with an omnichannel strategy start selling D2C without having clear goals defined for the channel. If an objective is defined, it is often something to do with getting closer to the end customer; but revenue growth is typically not the main objective of the D2C channel.

Why is this? Largely because of retailer relationships and trying to avoid competition with one’s own retail partners. Brands with D2C sales still depend on their retail network, so they need to ensure they are not endangering revenue from those retail partners. Brands take their retail network’s prices into account and will mostly choose to be a late follower, meaning the brand does not follow the cheapest price in the market. Instead, it keeps its price at a certain level for a period of time to give retailers more flexibility and the chance to sell their products first. This strategy also helps brands to earn good visibility in the market for new products.

The resulting pricing strategy is not to offer the cheapest price, which could also erode brand identity, but instead to price alongside the market.

The role of PLC in brand pricing strategies

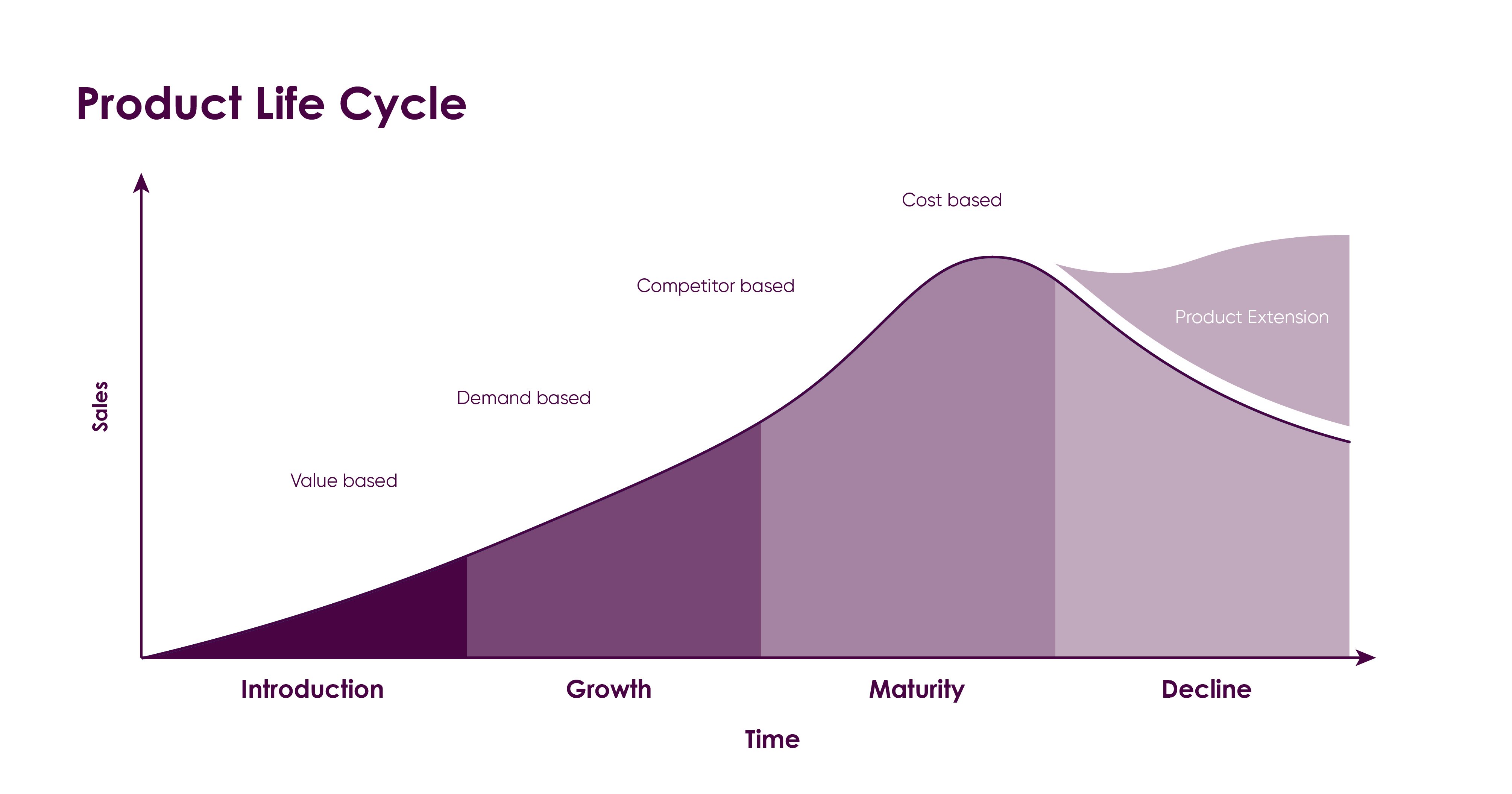

For brands, the pricing strategy throughout the PLC may look like this graphic:

Following the pricing of the market requires brands to be aware of where each product in their assortment is in its PLC and how the pricing should adjust to match. Defining the length of a product’s lifespan can be challenging, and conventional wisdom is often that PLCs are shrinking over time; however, there is no strong empirical evidence of shortening PLCs at the product category, industry, technology, or model level.

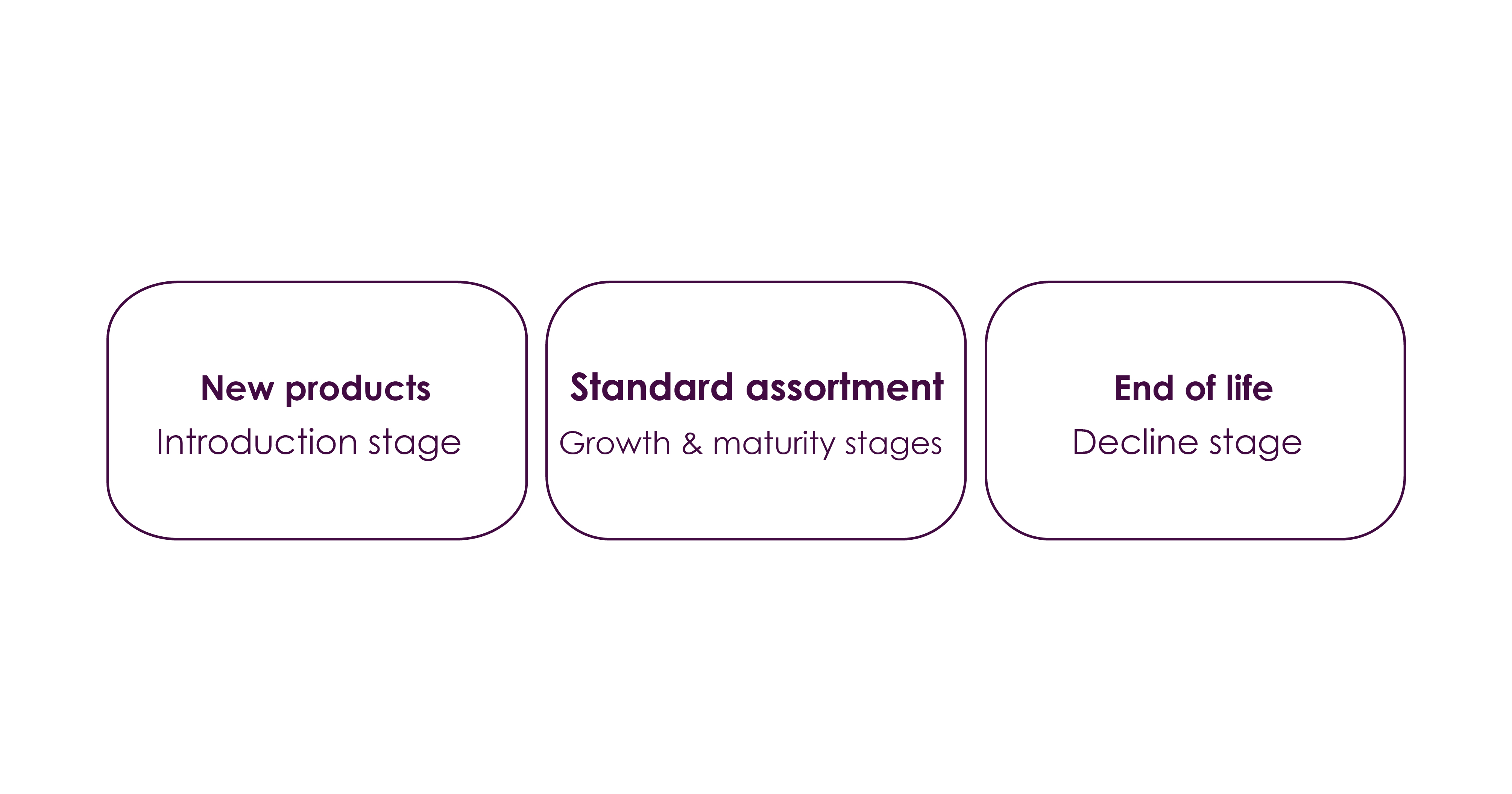

To weave Product Life Cycle into the “follow the market” pricing strategy described earlier, brands should start by building groups of products according to their stage in the cycle:

Pricing tactics can then be assigned to each product group. Brands should define the maximum discount, or price boundary, for each group and define how the market price will be followed; for example, D2C will have the cheapest price, or 5% over the cheapest price, and so on.

Depending on the PLC stage a product is in, brands should define allowable ranges for discounts. Usually, the scale of discounts would increase over time, as a product moves toward the end of its life cycle. For example, let’s consider a hypothetical furniture brand called ABC Couches. The brand’s “Super-blue ultra-comfy couch” launches in 2023 and has the following price boundaries.

Introduction stage: Maximum discount given in the market is 10%

Growth and maturity stages: Maximum discount given in the market is 15%

Decline stage: Maximum discount given in the market is 30%

Of course, brands cannot base their pricing strategies for D2C products solely on the Product Life Cycle. Other factors, like seasonal promotions, will also play a role.

Talk to one of our consultants about dynamic pricing.

The intersection of seasonal promotions and PLC

Seasonal promotions are not completely separate from pricing based on Product Life Cycles; in fact, they can work together for a successful brand pricing strategy. The strategic goals of a seasonal promotion can differ by PLC stage:

- Introduction stage: When a new product launch is timed to coincide with a seasonal sale, promotions could be used to accelerate the launch.

- Growth stage: Seasonal promotions are used to continue growth of the product. At this stage, brands are more focused on demand-based pricing, so that will be a factor.

- Maturity stage: Brands trend toward competitor-based pricing in this stage, so seasonal promotions may be used to match or win versus competitor products.

- Decline stage: A promotional program or seasonal discount can be used to sell off a current item if a new or updated product is launching soon. This may also temporarily improve the sales outlook during the decline stage, but any improvement stemming from a non-product tactic is likely to be short-lived.

As mentioned previously, brands will typically take into account the prices offered by their retailers when using seasonal promotions. If their aim is to price alongside the market, then they will want to ensure any seasonal discounts do not drastically undercut their retailer partners. Brands will also need to consider other potential effects of reducing a price: From how consumers and competitors will respond to how it could impact brand identity.

Other factors that impact Product Life Cycle and pricing

One size does not fit all when aligning a brand’s pricing strategies with the Product Life Cycle. A number of other factors may be at play when setting a pricing strategy.

How PLC differs between verticals

Finding statistics on the “average Product Life Cycle” is almost impossible, because it is so dependent on the specific product, vertical, category, and other factors. But while we cannot define an exact length of time for the average PLC, it is interesting to look at the difference in PLC length relative to other verticals.

For example, fashion is known for having relatively short Product Life Cycles compared to other verticals. Most fashion brands operate based on seasons, releasing new items in preparation for each new season. While seasonality, both holiday-driven and climate-driven, and Product Life Cycles are not the same, some products, particularly those that are part of a “fad” or fast fashion trend, may see their Decline stage (end of life) as soon as the end of the season arrives. Other products, like basics, may have a much longer PLC. And then there are the products that have multiple life cycles; for example, fashion trends from the 90s that went through their Decline stage and have since come back into style, with updated versions increasing sales in the 2020s. Shorter Product Life Cycles mean that fashion brands will have different pricing strategies and may change pricing more quickly and often compared to other verticals.

Depending on the channel, pricing strategies based on the Product Life Cycle may need to be altered. Brands could decide that products in the Decline stage, also called End-of-Life or EOL products, might be sold only online rather than in physical stores. While retailers can benefit from the traffic of seasonal sales to sell of EOL products, D2C brands have few or no physical stores, and the ones they do have work differently than traditional retail.

Another example would be differences in location. Seasonality is flipped depending on the hemisphere, so the Product Life Cycle and seasonal pricing strategies would be different in Europe versus South America.

The PLC of campaign-specific products

Consumers are also looking at user-generated content such as reviews, ratings, and recommendations, which can serve as powerful motivators to buy. While influencer marketing is certainly widely used, consumers say they are most likely to take product recommendations from everyday users like friends and family (37%) versus subject matter experts (25%), celebrities (7%), social media influencers (6%) or even the brand’s social media account (8%).

Some products are designed and created only for special marketing campaigns, such as promotions run by or through celebrities. These products may only be sold for a limited time, giving them a predefined Product Life Cycle and different pricing strategy. One example of this would be Kyle Jenner’s Birthday Collection that sold out in 30 minutes and was restocked, but only available until her birthday on August 10th.

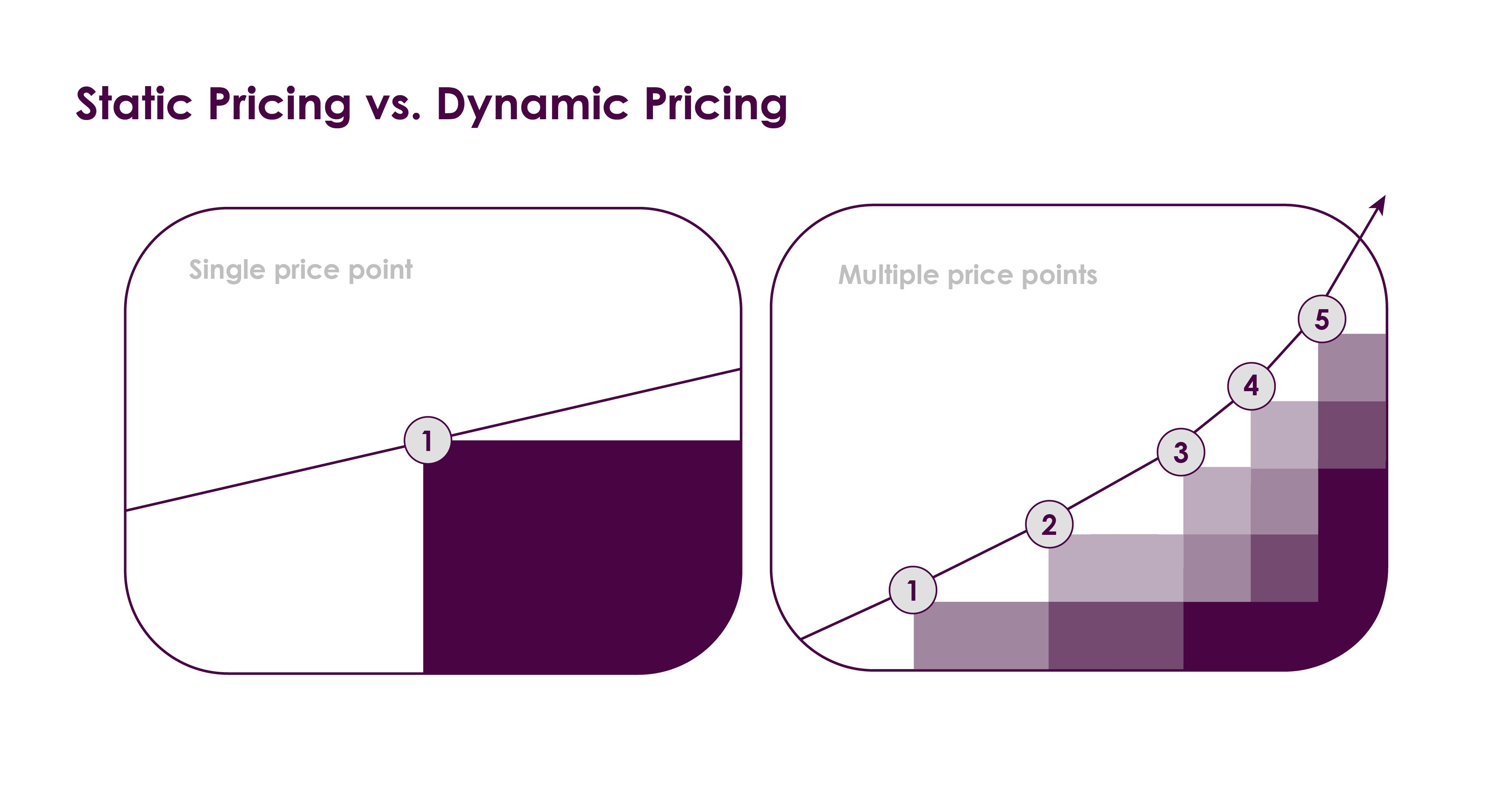

To effectively price based on PLC, brands need Dynamic Pricing

Pricing products according to their stage in the Product Life Cycle can be an effective strategy, but this requires the right data and automation to maximise the impact of promotions. Businesses can use dynamic pricing technology, also called real-time pricing, to automatically adjust prices to account for changing demand, competitor prices, market fluctuations, and other factors. This allows companies to capture more revenue by deploying the right price, on the right channels, at the right moment.

Source: Hubspot

Using a solution like Omnia Retail’s Dynamic Pricing makes it simple to run both planned and dynamic promotions, so brands can maximise sales of the full range of their product assortment from introduction to end-of-life. Try it for free.

.png?height=766&name=Untitled%20design%20(21).png)