The end of the third quarter of 2023 saw TikTok launch its new Shop tab in the US market, adding to an already unpredictable and fast-moving marketplace arena. While it may be too early to place its seat in the market, TikTok Shop brings all kinds of possible scenarios and questions: How will this affect Amazon and other large marketplaces? How will consumers approach shopping on this new platform? How will this impact the current social commerce playground? Social commerce is set to grow faster than e-commerce in the coming years, with an expected annual growth rate of 32% from 2023 - 2030, creating a landscape that increases the competition for marketplaces such as Amazon, eBay and bol.com. Omnia unfolds how TikTok Shop will play out for brands and retailers looking to focus their energy and budgets on social media.

Consumers will buy into content, not products, on TikTok Shop

The virality of TikTok content has shown how the intertwining of content and shopping results in sales, profit and brand awareness. TikTok Shop’s marketplace will be relying heavily on a content-first strategy to influence buying behaviour, which will essentially replicate its already highly successful and addictive video content section that saw unexpected brands, especially in beauty, reach new heights when influencers, bloggers or ordinary app users include a shop link to a product.

What TikTok seems to get right is that it centers shareability more than its rival social commerce platforms, making app users (and potential shoppers) more likely to want to get in on the trend - whatever that trend may be at any given time. According to HubSpot, 77% of TikTok users prefer it when a brand creates content around challenges, trends or memes, encouraging people to join. But more than that, brands with little to no advertising presence on TikTok are finding success simply because creators are using, posting and tagging product links. As the Business of Fashion states, “TikTok has become a beauty shopper’s playground.” For example, the hashtag #snailmucin has 776 million views (at the time of writing), which has helped COSRX’s snail mucin serum reach global corners.

Content will be king in TikTok Shop’s success, however, in the short term, we do not see them overtaking as e-commerce’s new behemoth. This does not mean that marketplaces should not be wary of the growth trajectory of social commerce platforms: Social commerce will account for 50% of US e-commerce sales by 2027.

TikTok Shop may replace Instagram as the leading social commerce platform

The age of influencers on social media reached a stale point, in the last three years, since the height of the Covid-19 pandemic in 2020, as consumers faced loss and tragedy on a grand scale. However, as cycles go, consumers have rebounded from contemplating the meaning of life and the urge to shop, travel and look their best has returned with gusto in 2023, despite inflation.

For brands and retailers, this is good news: The age of influencers is back, and this time it’s not on Instagram.

Source: IMF World Economic Outlook 2023.

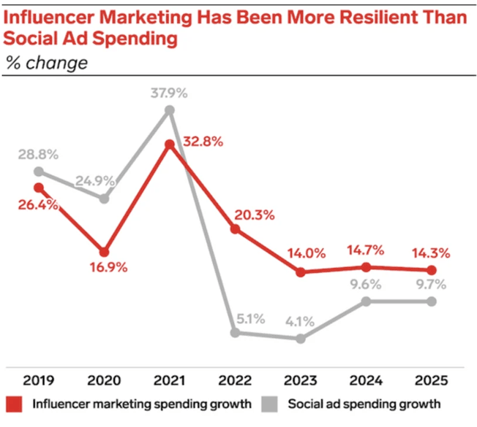

In the above graph we see how influencer marketing drastically dipped from 2021 - 2023 but plans to rebound in 2024 and onwards. The more interesting observation is how influencer marketing plans to remain stronger than social ad spending, which bodes well for TikTok Shop influencers going forward.

Moreover, TikTok Shop’s e-commerce viability is even stronger than some may think: Although Meta platforms have been at it for longer, Instagram’s removal of their Shop tab in January as well as the withdrawal of in-app product links for influencers means that editorialised product virality has moved away from Instagram and more towards TikTok Shop’s corner. In addition to Instagram removing its Shop tab, the platform is also much stricter on - if not altogether against - independent vendors that may fall into the grey market. On TikTok Shop, however, independent sellers and influencers can revel in a much more lenient, open-air system that focuses more on sales than it does on legitimacy.

Additionally, with adult social media users spending more time, on average, on TikTok (54 minutes per day) than Instagram (33 minutes), Omnia is curious to witness how consumers and social media users will approach each platform, especially considering the differences in how each platform tackles shopping. According to Insider Intelligence, TikTok Shop will have just over 33 million buyers in the US in 2023 alone just after its September launch. Even though this is lower than Facebook (65 million in 2023), the percentage of shoppers on each platform is equal at 37%, making TikTok the faster-growing e-commerce choice for shoppers.

Talk to one of our consultants about dynamic pricing.

Early hiccups include fake products and an unrefined algorithm

However, it is not all sunshine and roses for TikTok Shop, as a large number of products on the platform seem to be low-quality goods from China. Bloomberg News, through a look at the Shop tab’s listings, found that many of the goods that are “recommended” by the app are outdated and irrelevant such as waist trainer vests, or simply a random choice of items from mini clay statues to budget planners, akin to what shoppers would see at a garage sale.

Other issues include products that are counterfeited such as fake Nike sweaters and skincare products from Korean brand COSRX that are heavily and suspiciously underpriced and labelled as being made in China while the brand is well known for being produced in Korea.

In this early stage of the marketplace’s launch in the US market, it is crucial for the algorithm that creates a user’s particular interests to impress and lead to conversions, especially since TikTok’s parent company, ByteDance, has set its eyes on selling $20 billion worth of merchandise in the next year. This rivals Amazon’s target for the US market too, however, what TikTok should try to avoid with their new shopping platform is the disorganised and unvetted flea market style that this early version of TikTok Shop is currently presenting to some users which is reminiscent of eBay’s and Amazon’s earlier days of jam-packed categories and sub-categories of vendors.

In addition, some luxury and established brands within fashion and beauty are hesitant to jump into the TikTok tide, fearing brand depreciation due to the association of possible counterfeiters, leaving TikTok on the outskirts of a lucrative revenue stream.

A volatile start with pros and cons

In 2022, as a content-creating-specific platform, TikTok still outweighed Instagram (16.4%) and YouTube (17%) as the number one destination for shopping on social commerce, with 21% of consumers who use social media to shop selecting TikTok. As the platform improves and bolsters its shopping features, that number is only set to rise.

Regarding the platform’s algorithm issues and reliability as a trusted marketplace with vetted sellers, ByteDance may experience setbacks in the US market. Policymakers remain concerned that consumer data is at risk of being misappropriated via Chinese vendors. TikTok Shop will have to work harder to onboard American vendors located within the US to avoid legal ramifications as well as a deterioration of trust among shoppers.

Marketplace market share still resides in the hands of the larger marketplaces, but this we already know - what we don’t know and will anticipate learning is how consumers react to this developing channel of shopping, and what the long-term arc of TikTok Shop will be as e-commerce leaders fight for growth and market share.

.png?height=766&name=ORA%20Visuals%2020252026%20(11).png)