Price Points by Omnia Retail

10.03.2025

Competitive Pricing as a Strategy: What Most Businesses Get Wrong in 2025

Your product's price can determine your business's success or failure. A small price difference could win or lose a sale in today's crowded markets, even though competitive pricing might seem simple. Competitive pricing...

Your product's price can determine your business's success or failure. A small price difference could win or lose a sale in today's crowded markets, even though competitive pricing might seem simple. Competitive pricing provides a straightforward way to position products in the market. Many businesses make the mistake of simply copying their competitors' prices. This approach often leads to missed opportunities and lower profits. Smart competitive pricing needs careful price selection based on market competition. The goal isn't to slash profits or start a race to the bottom. This piece reveals common misconceptions about competitive pricing strategies. You'll discover how these strategies work and why pricing software gives you up-to-the-minute data analysis to make smarter pricing decisions. The discussion includes practical examples to help you dodge typical mistakes, plus the pros and cons of competitive pricing. What is Competitive Pricing? Competitive pricing is a strategy where businesses set their prices based on the prices of their competitors. Instead of determining prices solely based on production costs or desired profit margins, companies analyze the market and adjust their pricing to stay competitive. This approach is commonly used in highly competitive industries, such as retail and e-commerce, where price sensitivity plays a crucial role in consumer decision-making. The benefits of competitive pricing The primary benefit of competitive pricing is that it helps businesses attract price-conscious customers and increase sales. By offering prices that align with or undercut competitors, companies can improve their market position and boost customer loyalty. Additionally, this strategy allows businesses to react quickly to market changes, ensuring they remain relevant and appealing to consumers. However, it requires continuous monitoring of competitor pricing to maintain effectiveness. Why Most Businesses Fail at Competitive Pricing Businesses often struggle with competitive pricing because they don't understand the basics. Studies show that competitor-based factors explain 30.2% of price variations in certain markets. Focusing only on competitor prices Your business success faces real risks when you blindly copy competitor prices. You make poor decisions by setting prices without knowing your competitors' strategies or costs. Price wars often start when businesses only try to match or undercut competitors, especially in markets with many competitors or price-sensitive customers. Smart businesses analyze their unique value instead of just matching market prices. Companies that only rely on competitor pricing lose their grip on real market demand over time. Lower prices don't always attract more customers - they can make people doubt your product quality and cut into your profits. Ignoring customer value perception Businesses make a huge mistake when they overlook how customers link price to value. Studies show 71% of shoppers trust the brands they buy from, with Gen Z caring about this the most. Customers judge value based on quality, brand reputation, and their overall experience. Price makes up just one part of the value equation. Research of McKinsey shows customers decide to buy based on what they think they'll get minus what they think they'll pay. The best pricing strategies look at both sides rather than just focusing on costs. Not considering market dynamics The market keeps changing, and so should your pricing strategy. Businesses must keep checking their pricing approaches to stay ahead of competitors. Keep an eye on supply and demand changes that affect pricing, observe customer behavior and market trends, and adjust prices proactively while considering regional differences in perceived value. Retailers who use flexible pricing strategies can increase profits by 5% to 10%. But to keep your competitive pricing strategy working, you need to analyze the market constantly and adapt to new conditions. Key Elements of Successful Competitive Pricing Market positioning is the lifeblood of effective competitive pricing. Your market position helps you make pricing decisions that match customer expectations. Understanding market positioning Your market position shapes how consumers see your brand compared to competitors. You can build a unique identity in the marketplace through product features, price points, and quality indicators. Examples of competitive pricing strategies These effective competitive pricing approaches work well: Price matching: Your prices stay equal to competitors while you highlight unique value Premium pricing: Higher prices show superior quality or exclusive offerings Penetration pricing: Lower prices help gain market share, which works best for new market entrants Research shows that businesses that use dynamic pricing strategies see 5-25% more revenue when they adjust prices based on market demand. Advantages of competitive pricing Competitive pricing helps businesses attract customers by offering prices that align with or undercut competitors. This strategy can increase sales volume, enhance market positioning, and boost customer loyalty. It also allows businesses to stay relevant in highly competitive industries by responding quickly to market fluctuations. Advantages: Makes pricing easier Boosts sales volume Responds fast to market changes Guards market share Disadvantages of competitive pricing While competitive pricing can be effective, it also comes with drawbacks. Focusing solely on competitor prices may cause businesses to overlook critical factors like production costs, profit margins, and customer perception of value. This approach can lead to price wars, reducing profitability and making long-term sustainability more challenging. Disadvantages: Might not cover operating costs Could start price wars Misses customer value perception Wrong pricing happens if competitors make mistakes Your competitive pricing success needs constant market monitoring and smart positioning choices. Good pricing software and market analysis tools help you stay competitive while keeping profits healthy. Real-Time Competitor Pricing Insights As a large retailer or D2C brand, it's vital to monitor supply and demand changes affecting pricing. Observing customer behavior and market trends allows proactive price adjustments, ensuring competitiveness and meeting audience expectations. Regional value differences should also be considered. Price monitoring software is crucial for real-time monitoring, offering insights into market dynamics and competitor pricing. This tool helps maintain competitive and attractive prices, maximizing profits and strengthening market position. How to Set Up Competitive Pricing Strategies? A competitive pricing strategy works best with systematic implementation. Start by finding direct competitors who sell similar products and indirect competitors with alternative offerings. Next, build a data collection system using price-tracking software that pulls competitor pricing information automatically. The best results are driven by key factors such as market positioning and value proposition, which determine a product's competitive edge, along with inventory levels and demand patterns that ensure optimal stock management. Additionally, seasonal variations influence consumer behavior, while regional price differences play a crucial role in pricing strategies, all contributing to overall success. Automated pricing tools let you view data through different parameters. You can sort by price range, product performance, and shipping options. Of course, human oversight is vital - don't let algorithms make all your pricing decisions. Price intelligence software helps businesses spot opportunities and react quickly to market changes. This makes competitive pricing a vital part of business without cutting into profits. These tools help maintain the best price points through systematic monitoring while keeping profit margins healthy. Conclusion Price competitiveness drives business success, but matching competitor prices alone misses significant market opportunities. Companies that use strategic competitive pricing among modern pricing tools see revenue increases of 5-25%. Businesses thrive when they balance multiple pricing factors. A company's market position, customer perception of value, and operational costs matter as much as competitor prices. Price tracking software helps track these elements and make analytical insights that protect profit margins. Your unique value proposition matters more than constant price matching. Research indicates that 71% of customers value brand trust over the lowest prices. Pricing software helps spot opportunities, analyze market patterns, and adjust prices strategically without hurting profits. Price competitiveness needs constant monitoring and quick market responses. The right pricing tools and regular market analysis help maintain optimal price points and build strong customer relationships. Note that competitive pricing becomes a powerful strategy when used wisely, not as a simple copy-paste solution. Learn more about our revolutionary and intuitive approach to Dynamic Pricing here. What is Price Monitoring?: Check out everything you need to know about price comparison and price monitoring. What is Charm Pricing?: A short introduction to a fun pricing method. What is Penetration Pricing?: A guide on how to get noticed when first entering a new market. What is Bundle Pricing?: Learn more about the benefits of a bundle pricing strategy. What is Cost Plus Pricing?: In this article, we’ll cover cost-plus pricing and show you when it makes sense to use this strategy. What is Price Skimming?: Learn how price skimming can help you facilitate a higher return on early investments.

Competitive Pricing as a Strategy: What Most Businesses Get Wrong in 2025

23.12.2024

What is Price Discrimination and how to leverage it?

What is Price Discrimination? In today’s highly competitive retail landscape, pricing is no longer just a numbers game—it’s a strategic lever that can make or break a business. As consumer expectations evolve and...

What is Price Discrimination? In today’s highly competitive retail landscape, pricing is no longer just a numbers game—it’s a strategic lever that can make or break a business. As consumer expectations evolve and markets become increasingly fragmented, retailers face the challenge of setting prices that maximize revenue while staying competitive and meeting diverse customer needs. Price discrimination (also known as differential pricing or price differentiation) is defined as a strategy that involves tailoring prices based on customer segments, behavior, or willingness to pay and offers a powerful solution. It enables businesses to unlock hidden revenue potential, capture greater consumer surplus, and provide personalized value to their customers. When executed effectively, price discrimination doesn’t just boost profit margins; it also strengthens customer relationships by aligning pricing with perceived value. However, success in this area requires a deep understanding of market dynamics, robust data analytics, and the ability to navigate challenges like fairness and compliance. In this article, we’ll explore the fundamentals of price discrimination, its practical applications in retail, and how businesses can leverage this strategy to thrive in an increasingly complex marketplace. If you are interested in other pricing methods, check out our recent blogpost on 17 key ecommerce pricing strategies. 3 types of Price Discrimination Price discrimination is the practice of charging different prices for the same product or service based on specific customer characteristics, market conditions, or purchasing behaviors. It allows businesses to optimize revenue by capturing as much value as possible from diverse customer segments. Broadly, price discrimination is categorized into three types: First-degree price discrimination involves setting a unique price for each customer based on their willingness to pay. While challenging to implement, it can be seen in industries like real estate or high-end consulting, where prices are often negotiated individually. Second-degree price discrimination offers varying prices based on the quantity purchased or the version of the product chosen. For example, bulk discounts, tiered pricing plans, or premium product variations fall under this category. Third-degree price discrimination segments the market into distinct groups based on characteristics such as age, location, or time of purchase. Examples include student discounts, regional pricing, and off-peak travel rates. For price discrimination to succeed, three key conditions must be met. First, the business must have a degree of market power, enabling control over pricing rather than being dictated by competition. Second, the market must be divisible into distinct customer segments with different price sensitivities. Third, the company must ensure limited or no arbitrage between segments, preventing customers from exploiting price differences across groups. These principles form the foundation of effective price discrimination, enabling businesses to align their pricing strategies with consumer behavior while maximizing profitability. Price Discrimination Examples Price discrimination in retail and ecommerce manifests in various ways, tailored to the unique characteristics and purchasing behaviors of different customer segments. Subscription-based services like Amazon Prime or Dropbox offer another example of second-degree price discrimination, utilizing tiered pricing structures to cater to diverse customer needs. For instance, Dropbox offers four different plans, allowing customers to choose based on their usage preferences and budget. Another proven method is regional price discrimination (third-degree price discrimination) and involves setting prices based on geographic factors like local market conditions or cost of living. Retailers might charge higher prices in metropolitan areas compared to rural regions, or low-income vs high-income countries, like the Big Mac index from McDonalds, reflecting differences in purchasing power and operational costs. At last, another common example of third-degree price discrimination is dynamic pricing, where prices fluctuate based on demand, inventory levels, or customer behavior. This approach is widely used in e-commerce, where pricing software adjusts prices in real-time to optimize sales, as seen during flash sales or peak shopping seasons like Black Friday (see below). When to use Price Discrimination? Deciding whether to leverage price discrimination in your business requires understanding its feasibility, customer impact, and potential to boost profitability. Here’s a structured way to evaluate it: 1. Understand your Market Segments Before implementing price discrimination, ensure you have a clear understanding of your customer base. Are there distinct groups with varying willingness to pay, such as business users versus personal users or price-sensitive versus convenience-focused customers? Effective segmentation is essential, and this can be achieved by analyzing demographic factors, geographic location, purchase intentions, or other attributes. The better you understand your market segments, the more tailored and effective your pricing strategy will be. 2. Assess your Product/Service Not all products or services are suitable for price discrimination. Consider whether your offering has elastic demand—products with varying perceived value among customers are better suited for this strategy. Additionally, low marginal costs are a key factor; price discrimination works best when the cost of serving an additional customer is minimal, allowing you to capture value without significantly increasing expenses. 3. Check Operational Feasibility Implementing price discrimination requires robust operational support. Do you have the tools and data systems necessary to execute dynamic pricing or customer segmentation? Advanced analytics and real-time data are critical for success. Additionally, ensure you can enforce segmentation effectively; preventing arbitrage, such as customers reselling products between segments, is crucial to maintaining the integrity of your strategy. 4. Analyze the Competition Understanding the competitive landscape (see below) is vital when considering price discrimination. Are your competitors already using this strategy? If so, it may indicate that customers in your market expect it, and adopting it could help maintain competitiveness. However, you must also evaluate how price discrimination might affect your market position—while it could strengthen your edge, it might also alienate certain customer segments if perceived as unfair. 5. Test and Iterate Price discrimination is rarely a one-size-fits-all approach. Start small by running limited experiments, such as A/B tests or pilot programs, to gauge customer responses and measure outcomes. Use these insights to refine your strategy, making data-driven adjustments as needed. Iterative testing ensures that your approach evolves with your customers’ needs and market dynamics, maximizing effectiveness while minimizing risks. When to avoid Price Discrimination? Retailers and D2C brands should avoid price discrimination when there is no customer segmentation possible, or when there is a risk of harming customer trust or brand values like transparency and fairness. It's also unwise in highly commoditized markets, where customers can easily compare prices. A thoughtful, transparent approach ensures pricing strategies align with both business goals and customer expectations. So in summary: No clear segmentation: If customers have similar willingness to pay, it won’t yield benefits. High enforcement costs: Preventing abuse or arbitrage may outweigh the benefits. Negative customer impact: If it leads to backlash or distrust, it could harm your brand long-term. Addressing fairness and compliance concerns While price discrimination can drive significant business benefits, it also raises important ethical and legal considerations. Striking the right balance between profitability and fairness is crucial to maintaining customer trust and avoiding reputational risks. One key concern is the perception of unfairness when customers discover they are being charged different prices for the same product. Transparency can help mitigate this issue—clearly communicating the basis for price differences, such as discounts for loyalty or reduced prices during promotional periods, can ensure customers feel the pricing is justified. Another challenge lies in navigating regulatory frameworks that govern pricing practices. For instance, certain forms of price discrimination, such as discriminatory pricing based on race, gender, or other protected characteristics, are illegal in many jurisdictions. Retailers must carefully design their pricing strategies to comply with these laws while achieving their business objectives. Ethical price discrimination requires a careful balance: leveraging data to offer personalized and value-driven pricing while ensuring fairness, transparency, and compliance. Retailers who prioritize these considerations can implement price discrimination strategies that enhance customer satisfaction and maintain long-term loyalty.

What is Price Discrimination and how to leverage it?

01.10.2024

Top 7 strategies for successful digital pricing transformation

7 Strategies for Successful Digital Pricing Transformation Pricing transformation means completely changing the way a company sets its prices, using new digital tools and technologies to make better pricing decisions....

7 Strategies for Successful Digital Pricing Transformation Pricing transformation means completely changing the way a company sets its prices, using new digital tools and technologies to make better pricing decisions. This process aims to set prices that accurately reflect the perceived value of products or services, dynamically respond to market competition, and maximize profitability. Leveraging software solutions, businesses can ensure they are setting optimal prices for each transaction, considering factors such as customer demand, market trends, and competitive landscapes. In today's rapidly evolving business landscape, pricing transformation has become a critical priority for organizations seeking to stay competitive and maximize profitability. As market dynamics shift and customer expectations evolve over time, companies must adapt their pricing strategies to keep pace. Pricing platform provider Omnia Retail has joined forces with Horvath, the international management consultancy with a focus on transformation and digitization, to share insights on the key elements of success we observe in businesses that have successfully undergone a pricing transformation. Drawing on our combined expertise in pricing software and strategies, we've identified seven key pillars that can help businesses successfully navigate this crucial process: 1. Secure Full C-Level Sponsorship The foundation of any successful pricing transformation lies in obtaining full support from top management. Our experience shows that pricing transformation needs to be a top priority for sales and marketing, product management, finance, and IT departments. Without strong backing from the C-suite, pricing initiatives often struggle to gain traction, especially because they impact many teams and may fail to deliver the desired results. With C-level sponsorship, the right KPIs (profit/revenue) can be prioritized effectively within each team. To achieve C-level sponsorship, we suggest: - Articulate the potential value and impact of pricing transformation on the company's top line - Develop a compelling business case that outlines both short-term wins and long-term strategic benefits - Quantify benefits by running a proof of concept (POC) where you A/B test the effectiveness of your pricing strategies - Ensure that pricing objectives are aligned with overall business goals and strategy By making pricing transformation a C-level priority, companies can ensure that the necessary resources, attention, and support are allocated to drive meaningful change. 2. Foster Collaboration Between Business and Technology Teams Successful pricing transformations are not solely a business initiative or an IT project; they require seamless collaboration between both domains. Our experience shows that when both the business and IT sides feel ownership, a well-developed pricing strategy will take shape and can be effectively implemented. We suggest to consider the following: - Establish cross-functional teams that bring together business expertise and technical knowledge - Ensure clear communication channels between business stakeholders and IT professionals - Develop a shared understanding of pricing goals, challenges, and potential pitfalls - Leverage technology as an enabler of pricing strategies, not just as a tool for implementation Remember, introducing pricing software alone does not solve pricing problems. It's the synergy between business acumen and technological capabilities that drives true transformations. 3. Focus on Big Wins and Quick Victories While pricing transformation is often a long-term journey, it's essential to maintain momentum by focusing on major achievements and celebrating quick wins along the way. To do so, we suggest the following: - Build confidence in the transformation process - Demonstrate tangible value to stakeholders early and fast (e.g. the aforementioned POC) - Generate enthusiasm and buy-in across the organization - Secure ongoing support and resources for the initiative To achieve this: - Start with an isolated part of the business. E.g. one category or 1 geographical location. This allows for a quicker ROI and lower time investment. Successful pilots then typically serve as boosters for global roll-out. - Identify high-impact areas where pricing improvements can yield significant results such as focussing on highly dynamic product groups, Key Value Items (KVIs), and high runners. - Use available technology in steps. First automate the more tedious tasks to free up time, then use that time to focus on developing commercial strategy in more depth. - Celebrate and communicate successes internally to maintain motivation and engagement as a transformation needs to be sold internally as well in its early stages. Any improvement in pricing should pay for itself. By delivering on quick wins, you can cross-finance the journey and support fast achievements, creating a positive cycle of improvement and success. 4. Internalize Pricing Know-How External consultants and software partners can kick-off a pricing transformation. They will generate value quickly but it’s crucial to internalize pricing know-how within your organization. Both for adoption and continuity, dedicated resources are critical. This ensures long-term success. We suggest following steps to internalize pricing knowledge: - Invest in training and development for your team - Document how you develop and execute your pricing strategy - Encourage knowledge sharing and best practice dissemination across departments/teams/countries - Use a proper pricing platform that enables collaboration & knowledge sharing within your organization - Develop a pipeline of pricing talent within your organization By making a pricing transformation program truly yours, you build internal capabilities that will drive continuous improvement and adaptation to market changes. 5. Include Local Teams in the Process Pricing transformation should not be an "ivory tower" exercise conducted solely at headquarters. To ensure success, it's crucial to involve local teams and incorporate diverse perspectives from across your organization. We suggest the following to include local teams: - Engage sales representatives in target markets to gather on-the-ground insights - Seek feedback on conceptual and design ideas from front-line employees - Involve top performers from various regions in the transformation program - Conduct pilot programs in select markets to test and refine pricing strategies By going out and involving sales reps in markets, you can get valuable feedback, test ideas, and create a more robust and effective pricing transformation program. 6. Embrace Continuous Iteration and Adaptation In today's fast-paced business environment, a static pricing strategy is a recipe for obsolescence. Your competitors are constantly evolving their approaches, and your pricing strategy must do the same to remain effective and competitive. Following key reasons to prioritize continuous iteration: - Market dynamics change rapidly, affecting demand patterns and customer preferences - Competitors adjust their strategies, potentially eroding your competitive advantage - New technologies emerge, offering opportunities for more sophisticated pricing approaches - New competitors might pop-up or existing competitors might fundamentally change their commercial strategies in certain categories/geographies - Economic conditions fluctuate, impacting customer purchasing power and behaviour To implement an iterative approach to pricing: - Establish a regular review cycle for your pricing strategy, considering both short-term adjustments and long-term strategic shifts - Leverage data analytics to monitor market trends, competitor actions, and the impact of your pricing decisions in real-time - Create a feedback loop that incorporates insights from sales teams, customer service, and market research - Develop scenario planning capabilities to anticipate and prepare for potential market shifts - Foster a culture of experimentation, where testing new pricing approaches is encouraged and learnings are quickly incorporated By committing to continuous iteration and adaptation, you ensure that your pricing strategy remains agile, responsive, and ahead of the curve. This iterative mindset will help you stay one step ahead of competitors and maintain a strong market position in an ever-changing business landscape. 7. Ensure Transparency and Organization-Wide Understanding A successful pricing transformation goes beyond just implementing new strategies and technologies. It's crucial that the entire organization understands and embraces the new approach. Transparency in both the strategy and the tools used to execute it is key to preventing resistance and fostering widespread adoption. Following key reasons why transparency is critical: - Builds trust across departments and hierarchical levels - Increases buy-in and commitment from all stakeholders - Facilitates better decision-making at all levels of the organization - Prevents the "black box" syndrome where pricing decisions seem arbitrary or unexplainable Steps to promote transparency and understanding: - Clearly communicate the rationale behind the pricing strategy to all employees, not just those directly involved in pricing decisions - Provide comprehensive training on the new pricing approach and any associated software or tools - Ensure that the pricing software used is user-friendly and provides clear explanations for its recommendations - Provide access to relevant pricing dashboarding broadly in the organisation - Create accessible documentation that outlines the principles, rules, and logic behind the pricing strategy - Establish open channels for questions, feedback, and suggestions from employees at all levels - Regularly share success stories and case studies that demonstrate the positive impact of the new pricing approach If a pricing strategy is not understood, it is unlikely to be effectively implemented. By prioritizing transparency and fostering organization-wide understanding, you create an environment where everyone from sales representatives to C-suite executives can confidently explain and support the pricing decisions being made. A pricing transformation is a complex yet critical process for retailers aiming to thrive in today's dynamic market. By implementing these seven key strategies, organizations can set themselves up for long-term success. As market dynamics shift, customer expectations evolve, and competitors adjust their strategies, your pricing approach must remain flexible and responsive. By internalizing expertise, leveraging technology wisely, and fostering a culture of pricing excellence throughout your organization, you can create a pricing strategy that is both robust and adaptable. At Omnia Retail and Horvath, we're dedicated to helping businesses navigate the complexities of pricing transformation. By leveraging our combined expertise in retail pricing strategies and management consulting, we provide comprehensive solutions that drive sustainable growth and profitability. As you embark on your own pricing transformation journey, keep these seven key strategies in mind. With the right approach, commitment to transparency, and a willingness to iterate and adapt, you can unlock the full potential of your pricing capabilities. This will not only lead to improved financial performance but also position your organization to swiftly respond to market changes and maintain a significant competitive advantage in your industry. Read more about pricing strategies here: What is Dynamic Pricing?: The ultimate guide to dynamic pricing. What our the best pricing strategies?: Read about 17 pricing strategies for you as a retailer or brand. What is Price Monitoring?: Check out everything you need to know about price comparison and price monitoring. What is Value Based Pricing?: A full overview of how price and consumer perception work together. What is Charm Pricing?: A short introduction to a fun pricing method. What is Penetration Pricing?: A guide on how to get noticed when first entering a new market. What is Bundle Pricing?: Learn more about the benefits of a bundle pricing strategy. What is Cost Plus Pricing?: In this article, we’ll cover cost-plus pricing and show you when it makes sense to use this strategy. What is Price Skimming?: Learn how price skimming can help you facilitate a higher return on early investments. What is Map Pricing?: Find out why MAP pricing is so important to many retailers.

Top 7 strategies for successful digital pricing transformation

17.09.2024

17 Winning Pricing Strategies in e-Commerce

Setting the right price for your e-commerce products is like playing a game with extremely high stakes, no clear rules and ultra-intense competition. Choose the right price over time and you can win over your target...

Setting the right price for your e-commerce products is like playing a game with extremely high stakes, no clear rules and ultra-intense competition. Choose the right price over time and you can win over your target customers, creating loyal buyers who keep your business growing for years to come. Choose the wrong price and everything could go south, quick. So, how can e-commerce merchants choose the right pricing strategy or combination of strategies? In this comprehensive guide, Omnia covers 17 common pricing strategies in e-commerce and offers some advice for finding the right action plan for your business. What are e-commerce pricing strategies? E-commerce pricing strategies are approaches used by online businesses to determine, adjust and maintain the prices of their products or services over time. Strategies should take into account the company’s revenue goals, production costs, and other KPIs like customer lifetime value (CLV) and average order value (AOV). What is the difference between a pricing strategy and pricing rule? A pricing strategy is the high-level concept behind pricing decisions and policies, while a pricing rule is goal-oriented and about the actual execution of that strategy. Perhaps a retailer chooses a premium pricing strategy, where they price a product higher than market average, in order to increase the perceived value; for example, pricing a black chair higher than the average of all black chairs. The pricing rule in this case is the concrete translation of a price formula for a product or product group. In the Omnia platform, this would mean: New price = Market average price x 1.2 So, the price will be calculated and set to be 20% higher than the market average that day. With Omnia, this can be also combined with conditions, filters and more. The complexity of a rule is limitless. Top pricing strategies for retail and e-commerce There are endless examples of pricing strategies in e-commerce, so we compiled a list of 17 common types of pricing strategies below: Dynamic Pricing Dynamic pricing is a pricing strategy where companies or stores continuously adjust prices during the day to optimise margins and increase sales. The strategy applies variable prices rather than fixed prices, meaning they don’t have to decide on a set price for a season, but can instead adapt to the ever-changing market. It is important to note that although the two strategies are often confused, dynamic pricing differs significantly from personalised pricing, which focuses on the behaviours of an individual consumer and adjusts product pricing based on their past shopping experience. Premium Pricing Businesses using a premium pricing strategy want to keep their pricing levels higher than the competition. This can be paired with messaging and branding that shows customers why the higher price is justified. For a premium pricing strategy to work, sellers usually have to have some combination of a strong brand image, unique offerings or innovative product attributes. Examples of companies with a premium pricing strategy include Rolex, Apple and luxury fashion brands like Louis Vuitton and Chanel. Competitive Pricing One of the more common pricing strategies in e-commerce is competitive pricing, where sellers set their prices based on the prices of competitors. Competitive pricing is most often used by businesses operating in competitive markets or one with fairly similar products and little differentiation, as all sellers are then trying to win over the same customers. A competitive pricing strategy does not always indicate undercutting the competition, but rather setting prices in relation to competitors; this could mean setting product prices lower, higher or the same as competing sellers. Running a competitive pricing strategy with manual research can take a significant amount of time and is challenging in today’s fast-paced e-commerce environment. To make price adjustments for listings in real time, most companies use some type of Dynamic Pricing software. Value-based Pricing Value-based pricing, sometimes called value-added pricing or perceived value pricing, is a powerful strategy that requires a deep understanding of the market and of the value your products offer to potential customers. Sellers can use value-based pricing to shape how consumers perceive your product. Want to position yourself as a luxury brand, or to be the best value-for-money option? Price accordingly. Implementing value-based pricing demands extensive research into your target market and what the competition is doing, as well as reflection on and alignment with your business objectives. It will require collaborative effort across the organisation, but can create a very cohesive and effective pricing strategy. Price Discrimination Price discrimination, also called price differentiation or differential pricing, is a strategy employed by e-commerce companies to maximise profits by charging different prices to different customers for the same product or service, based on characteristics of the customer. The objective is to extract the maximum amount of consumer surplus and capture additional revenue based on individual customers' willingness to pay. To use this strategy, sellers make use of their vast amounts of customer data, including browsing history, purchase patterns, demographic information and geographic location. This data is leveraged to segment customers into different groups based on their preferences, behaviour and purchasing power. Once customer segments are identified, prices can be tailored to each segment's characteristics. For example, customers who have shown a higher willingness to pay in the past may be charged a higher price, while price-sensitive customers may be offered discounts or promotions to encourage purchases. The success of price discrimination in e-commerce relies heavily on sophisticated data analysis and algorithmic pricing systems. By leveraging customer data and market conditions, companies can optimise their pricing strategies to increase revenue and overall profitability. However, it is important to note that price discrimination can also raise concerns about fairness, privacy and potential consumer backlash if implemented in a way that is perceived as discriminatory or exploitative. Odd-Even Pricing Odd-even pricing falls under the category of psychological pricing strategies and taps into the psychology of numbers to influence consumer behaviour. Odd prices, like €5.99, are commonly used, but even prices, like €6.00, have their own psychological impact. This strategy can be employed in various ways, from offering strategic discounts to trying to create a memorable price point. For example, take a look at the difference between how luxury jewellery brand Tiffany & Co uses even pricing and more affordable brand Kay Jewellers uses odd pricing. Customers coming to Tiffany & Co. are looking for luxury items and are likely less price sensitive, so the company uses even pricing. Shoppers on the Kay Jewellers website may be more interested in finding a deal, so many of their prices use odd pricing and end in .99 or .95. Charm Pricing Charm pricing, also called psychological pricing, is similar to odd-even pricing, as it leverages pricing to evoke an emotional response and prompt action. This strategy is often observed in late-night infomercials, where potential buyers can be swayed by a price ending in “.99” or “.95” to make an impulse purchase. But infomercials aren’t the only place charm pricing is seen; many retailers use elements of this pricing strategy. There are a number of theories for why charm pricing is so effective: A perception of loss: This is when consumers value a product based on the loss they feel without it rather than the gain. In the Western world, most consumers read prices from left to right, so there is a high likelihood of grasping the first number as an anchor. Under this theory, that’s why €599 would feel so different from €600, even though there is only a separation of €1. A perception of gain: On the other side, perhaps consumers feel they have gained something, i.e. saved money, when they see an example of charm pricing. If the higher price of €600 is the anchor, then the lower price of €599 means you gained something and saved €1. This theory pairs well with the .99 or .95 pricing, which may make a consumer think they’re getting a discount. Specificity: With a charm pricing strategy, the price of an item is so specific that it can trigger a psychological response of customers believing it must be priced at the correct value. This is especially relevant if pricing is fractional, meaning it ends in a cent value. Example: Uniqlo Although the apparel brand rarely has sales, they signify to customers that they are getting a good deal by ending almost every price in “-9.90” or “-4.90”. Bundle Pricing Bundle pricing, also called product bundle pricing, is a strategy companies use to sell more items with higher margins while giving customers a discount for increasing the size of their order. Products are “bundled” so customers receive several different products as a package deal, costing them less than it would have if they made separate purchases of the included products. This incentivises purchases by creating higher perceived value and cost savings. E-commerce companies typically select complementary or related products and combine them into bundles to encourage larger purchases, increase average order value and enhance customer satisfaction. By offering discounted bundle prices, companies can attract price-sensitive customers, drive sales of slower-moving products and create a competitive advantage in the market. Promotional Pricing A promotional pricing strategy in e-commerce involves offering temporary price reductions or discounts on products or services to create urgency, stimulate sales and attract customers. The primary goals are usually to increase sales volume, clear out excess inventory, introduce new products or gain a competitive advantage. Promotional pricing can take various forms, such as percentage discounts, buy-one-get-one (BOGO) offers, limited-time sales, flash sales, coupon codes or free shipping. These promotions can be advertised or offered through any channel, from email marketing and social media to online ads or on-site banners. Predatory Pricing A predatory pricing strategy in e-commerce refers to a practice where a company deliberately sets extremely low prices for its products or services with the intention of driving competitors out of the market or deterring new entrants. By selling products at a loss or below cost for an extended period, the predatory pricer aims to eliminate competition and subsequently raise prices once competitors have been forced out. Predatory pricing is often considered anticompetitive and is illegal in many jurisdictions as it violates antitrust laws created for consumer protection and to ensure market competition is fair. Penetration Pricing A penetration pricing strategy is often employed by online sellers and business owners to attract customers to new products being brought to market. It involves offering an initial lower price than competitors to entice more buyers to purchase. The goal is to secure market share, undercut established sellers in the market and attract new customers who will remain loyal, even after prices are adjusted back up. For this e-commerce pricing strategy to succeed, however, there must be a high demand for the product. Without a significant market, penetration pricing becomes less effective. It's also important to make the price increases gradually to avoid competitors implementing their own penetration pricing tactics and stealing customers. Businesses employing a penetration pricing strategy will need price monitoring software to track and analyse average market prices over a set time period, then use the data to calculate introductory pricing. Price Skimming With a price skimming strategy, the product is initially priced high and then reduced later on, rather than starting with a low price like penetration pricing strategies. This approach aims to maximise short-term profits and segment customers based on how much they are willing to pay, and is often used for innovative products and products with high demand. The top level of customers, the most loyal ones, will buy at high prices. The seller can then continue accommodating new levels of potential customers by gradually lowering (“skimming”) the price. This practice continues until it reaches the base price. Price skimming can be a great way to quickly generate revenue and even break even with a lower number of sales, but companies must be able to rationalise the high price point, especially if the market is saturated and customers have other low-priced alternatives to choose from. One real-world example of a price skimming strategy is Samsung. When a new mobile phone release is planned and demand is high, the price is set higher to bring in more revenue and capture market share and attention from competitors like Apple. The newest model above, for example, retails for as much as €1.819,00 to start. After the demand and hype lessens, the company skims the price back down to reach more customers. Samsung Galaxy phones, for example, are priced to capture share from the iPhone. Price Optimisation Price optimisation is a practice used in most e-commerce businesses that involves analysing data from customers and the market to calculate and set the optimal price for a product. The objective is to find the ideal price point to attract customers and maximise sales and profits. The types of data used can range from demographics and survey data to historic sales and inventory. Pricing optimisation is similar to dynamic pricing, but while the former can be more of a long-term process, the latter is built more for rapid change and adjusts pricing based on real-time data. Surge Pricing Surge pricing is a pricing strategy that temporarily increases prices in response to high demand and limited supply. It is used in many industries, from hospitality and tourism to entertainment and retail. Here are three common types of surge pricing: Time-based: Adjusts prices based on the time of day or during special events and expected or real-time high demand periods. For example, online retailers raise prices between 9 AM and 5 PM when customers shop online during office hours, as well as during large, industry-relevant events, like the Olympics for sporting goods sellers. Weather-based: Incorporates weather forecasts to determine pricing decisions. When favourable weather conditions are expected, prices are increased. For instance, if the weather forecast promises good conditions for the summer, prices for beach goods, summer apparel and BBQs can be raised in anticipation of higher demand. Location-based: Adjusts prices based on the geographical location of the buyer. It is often observed in crowded cities or areas with high-income populations, where customers have a higher willingness to pay. Additionally, surge pricing may be used in places with above-average shipping costs, resulting in higher prices. Loss-leader Pricing Loss-leader pricing, often used as part of a penetration pricing strategy, involves intentionally selling certain products at a loss to attract customers and stimulate additional sales of other higher-margin products. The purpose is to entice customers with attractive prices on popular or essential items, with the hope or expectation that they will make additional purchases of complementary or higher-priced items. While the initial product may be sold at a loss, the strategy aims to generate profits through the sale of accompanying products or services. Effective implementation requires careful product selection, pricing analysis and understanding of customer behaviour to ensure the overall profitability of the business. Honeymoon Pricing Like penetration pricing, honeymoon pricing sets the initial product price low during launch to attract customers. This strategy is common in subscription models, where a low-priced starter offer entices customers who must then be retained. Retaining customers in this model can be achievable, however, since switching providers may be expensive or require too high a level of customer effort. Yield Pricing Yield pricing is a pricing strategy most often seen in the aviation and hotel industries. It involves pricing differently depending on when the customer makes the purchase. Airline seats, for example, are priced based on where you are in the booking period: Booking earlier gets customers a lower price, while late bookings are at a higher price point. This enables those airlines to avoid empty seats and lost profits. How to find the right pricing strategy for your e-commerce business Choosing the right e-commerce pricing strategy requires careful analysis and consideration, and it’s worth noting that most sellers use some combination of strategies. Here are five key steps to guide your research and discussions as you build your pricing strategy: Understand your market and customers: Conduct research to gain insights into customer preferences and market dynamics. Analyse costs and profit margins: Evaluate expenses and calculate desired profit margins to assess feasibility. Consider your business goals and value proposition: Align pricing with your objectives and unique value proposition. Test, monitor, and adapt your strategy: Implement and continuously evaluate your pricing approach to optimise results. Stay agile and regularly evaluate pricing against competitors: Keep an eye on the market and adjust pricing as needed to remain competitive. Over time, pricing strategies must adapt and evolve, both to keep up in the market and to meet the needs of the brand and product assortment. As you build, implement and execute your pricing strategies, Omnia Retail can seamlessly automate any strategy you choose, blending any combination of rules with advanced Machine Learning and AI algorithms. Learn more about our revolutionary and intuitive approach to Dynamic Pricing here. What is Price Monitoring?: Check out everything you need to know about price comparison and price monitoring. What is Charm Pricing?: A short introduction to a fun pricing method. What is Penetration Pricing?: A guide on how to get noticed when first entering a new market. What is Bundle Pricing?: Learn more about the benefits of a bundle pricing strategy. What is Cost Plus Pricing?: In this article, we’ll cover cost-plus pricing and show you when it makes sense to use this strategy. What is Price Skimming?: Learn how price skimming can help you facilitate a higher return on early investments.

17 Winning Pricing Strategies in e-Commerce

13.08.2024

The Ultimate Guide to Dynamic Pricing

What is Dynamic Pricing? Dynamic pricing is when a company or store continuously adjusts its prices throughout the day. The goal of these price changes is two fold: on one hand, companies want to optimize for margins,...

What is Dynamic Pricing? Dynamic pricing is when a company or store continuously adjusts its prices throughout the day. The goal of these price changes is two fold: on one hand, companies want to optimize for margins, and on the other they want to increase their chances of sales. Dynamic pricing is a pricing strategy that applies variable prices instead of fixed prices. Instead of deciding on a set price for a season, retailers can update their prices multiple times per day to capitalize on the ever-changing market. Dynamic pricing often gets confused with personalized pricing. But these two different types of pricing are extremely different from one another. To put it simply, dynamic pricing looks at your products and and their relative value in relation to the rest of the market. Dynamic Pricing vs Personalized Pricing Personalized pricing, on the other hand, looks at individual consumer behaviors and gauges (and changes) a product’s value based on past shopping experience. Personalized pricing is controversial because it uses individual data and shopping experiences information that many consumers consider private and personal. It’s also somewhat risky in an age where consumers can interact with and talk to each other like never before. If Consumer A finds out they paid more for the exact same product than their best friend, their trust in a company will erode. Dynamic pricing, on the other hand, allows you to capture extra sales and take advantage of a changing market without invading consumer privacy or trust. Why is Dynamic Pricing important in e-commerce? Dynamic pricing and e-commerce co-evolved together. As the internet became more sophisticated and online shopping grew, so has the need for dynamic pricing. Consumer electronics was one of the forerunners in the retail landscape in terms of the trend towards online. As a category of elastic products that are sensitive to price changes, it makes sense. Retailers need dynamic pricing to stay on top of the market and continue to offer competitive prices. But as consumer spending rises in this category (and with it the online market share), two developments that affect dynamic pricing have emerged: Increased price transparency: As more people shop for consumer electronics online, the amount of comparison shopping also increased. Consumers are now far more likely to evaluate a retailer’s prices against the company’s competition. This shines a spotlight on your product price and makes it the most important part of each sale. Since consumer electronics are typically highly elastic, a 5%-10% difference between your price and your competitors could be the deciding factor for a consumer. More frequent price changes: Because of this increased demand for price transparency and matching, the number of prices changes every day has increased dramatically since the dawn of e-commerce. Traditionally, the supplier or the manufacturer would determine the price of a product with a consumer advised price (CAP). However, this CAP quickly became irrelevant with the growth of comparison shopping online. Today, prices are determined by the retailer instead of a supplier, and are based on a variety of variables, including general market trends, competition prices, and stock levels. A complete guide to Dynamic Pricing Download free whitepaper A variety of other categories, such as Toys and Games, for example, follow the same pattern: when online spending rises, so does the demand for price transparency. This, in turn, leads to an increased frequency of price changes and the use of dynamic prices. This trend often also attracts new players on the market without physical stores, which makes it difficult for traditional retailers. Although the traditional retailers have the first mover advantage, they are generally less flexible in adapting their (pricing) strategy. However, the retailers that do capitalize on their omnichannel advantage can move ahead of the pack. What are the benefits of Dynamic Pricing? Dynamic pricing is no longer just a strategy for airlines, hotels or ride-sharing apps. For large retailers and D2C (Direct-to-Consumer) brands, embracing dynamic pricing can unlock significant growth opportunities, enhance profitability, and strengthen customer relationships. Here’s why dynamic pricing should be a cornerstone of your pricing strategy: 1. Maximizing Revenue Potential Dynamic pricing allows retailers and D2C brands to adapt prices in real-time based on demand, inventory levels, and market trends. By pricing high-demand products competitively or increasing margins on less price-sensitive items, you can optimize revenue streams without alienating customers. 2. Staying Competitive in a Fast-Moving Market Retail is a highly competitive space, where prices are compared at the click of a button. Dynamic pricing ensures that your brand remains competitive without resorting to blanket discounts, enabling you to respond to competitor price changes swiftly and strategically.Monitoring your competitors' prices enables you to quickly adapt your pricing strategies. 3. Improved Inventory Management For retailers and D2C brands, holding unsold inventory can lead to wasted resources and lost profits. Dynamic pricing can be used to strategically discount slow-moving products while maximizing profitability on in-demand items, keeping inventory turnover healthy. 4. Data-Driven Decision Making Dynamic pricing software harnesses advanced analytics to provide actionable insights into customer behavior, market conditions, and pricing performance. These insights enable brands to make smarter, data-backed pricing decisions, resulting in higher margins and better customer experiences. Dynamic Pricing software By leveraging pricing software, you can simplify the complexities of implementing dynamic pricing, integrate seamlessly into your operations, and realize measurable business outcomes. Most retailers practice a most basic form of dynamic pricing by discounting items at the end of a season or using a clearance sale to get rid of extra stock. However, dynamic pricing can go much further than a discount at the end of a season. When you use a dynamic pricing software, you can wield the power of data to capture more sales and take control of your assortment. Today, almost all major retailers will use some sort of dynamic pricing software. Dynamic pricing software has obvious benefits online: you can follow the competition, adjust prices instantly, and easily capture quantitative metrics about your store to improve your performance. Dynamic Pricing is also useful offline. Through the use of electronic shelf labels (ESLs), you can easily apply dynamic pricing practices to your physical store. This helps you keep your prices up-to-date with what you present online, and makes pricing management easier. Dynamic Pricing software can help you stay in control of your pricing strategies. What are Dynamic Pricing strategy examples? Traditionally, there are three basic ways retailers set their prices: the cost-plus method, the competitor-based method, and the value based method. The cost-plus method is the most simple out of all three. All you need to do is take the cost of your product and add the desired margin on top of that cost. The main advantage of cost-plus pricing is that it’s easy to understand and implement. However, its main disadvantage is that it only considers internal factors, ignoring external market conditions. To determine the margin or 'markup' percentage, use this simple formula: subtract the product's cost from its selling price, then divide that difference by the cost. Finally, multiply the result by 100 to get the markup percentage. The competitor-based method follows your competition. If your competitor changes their price, you’ll change your price as a result, whether that’s to be lower or higher than your competition. The main advantage of this pricing approach is that it considers external factors like competitor pricing. However, its downside is that it assumes competitors have accurately set their prices. The value-based pricing method follows the price elasticity of a product. Different consumers value items differently, so everyone has a certain threshold that they are willing to pay for a product. A value-based pricing method capitalizes on the public’s perception of the value of a product and charge accordingly. The main advantage of this pricing method is that it integrates both external and internal data, providing a balanced approach. However, its main drawback is its complexity, making it the most difficult pricing method to implement. Dynamic pricing software allows you to combine different pricing methods at the same time. Some softwares also allow you to incorporate other useful information, such as your stock levels, popularity score, and even the weather forecast. How Philips implemented Dynamic Pricing Read case study How to implement Dynamic Pricing? Implementing dynamic pricing is a journey, one that has a lot of twists and turns. And it does create a big change in your organization. That’s why you should view the adoption of dynamic pricing as an opportunity to improve your overall pricing strategy and internal systems, as well as your overall margin. After hundreds of implementation projects, we’ve come up with a five-step process to successfully implement dynamic pricing: Define your commercial objective: Your commercial objective is like your company’s compass: it’ll help you navigate any institutional changes and keep you heading in the right direction. The commercial objective applies to more than just pricing and marketing, but it’s the first step for a successful dynamic pricing strategy. Learn more about how to define your commercial objective here. Build a pricing strategy: Your pricing strategy takes your commercial objective, then translates it into strategy that your team will use to sell products. An example? Say your overall commercial objective is to be known as the cheapest retailer on the market. Your pricing strategy would then be to make sure every product in your store is cheaper than the competition’s offering. To develop an effective pricing strategy, follow a three-step approach. Learn how to build a pricing strategy here: Assess Your Place in the Market Start by evaluating your current pricing model—this is known as the "As-Is Situation." Gather stakeholders to review your existing approach and answer key questions: What is your current pricing model, and what are its strengths and weaknesses? Are you a market leader or a challenger? Is your focus on maximizing sales volume or overall profitability? This reflection helps you understand where you stand before making any changes. Build Your Pricing Strategy Framework Next, engage stakeholders in solution sessions to establish a shared understanding of the As-Is analysis. Many assume this step is unnecessary, but it's crucial to ensure everyone is on the same page about existing pricing strategies. Use these sessions to review findings and create a draft framework. This involves leveraging expertise from sales, segment managers, and pricing specialists to craft a strategy that aligns with your business goals and customer needs. Set Business Rules for the Future With a clear framework in place, the next step is defining the "To-Be Situation"—how you want your pricing to function going forward. Establish the levers and rules that will guide your pricing and calibrate them based on your analysis. After aligning internally, begin testing and iterating these rules using tools like Omnia to see what adjustments yield the best results. Choose your pricing method(s): Your pricing strategy tells you what you want to do. Your methods are how you’ll achieve those pricing goals. Your pricing methods are more specific than your pricing strategy. Establish pricing rules: Pricing rules tell your dynamic pricing software what to do. You should set a rule for every product that the software needs to track and change. Test and monitor: The final step for getting started with dynamic pricing is to test and monitor your software’s changes. Learn more about testing the effectiveness of your online pricing. Read more about interesting pricing strategies here: What our the best pricing strategies?: Read about 17 pricing strategies for you as a retailer or brand. What is Price Monitoring?: Check out everything you need to know about price comparison and price monitoring. What is Value Based Pricing?: A full overview of how price and consumer perception work together. What is Charm Pricing?: A short introduction to a fun pricing method. What is Penetration Pricing?: A guide on how to get noticed when first entering a new market. What is Bundle Pricing?: Learn more about the benefits of a bundle pricing strategy. What is Cost Plus Pricing?: In this article, we’ll cover cost-plus pricing and show you when it makes sense to use this strategy. What is Price Skimming?: Learn how price skimming can help you facilitate a higher return on early investments. What is Map Pricing?: Find out why MAP pricing is so important to many retailers.

The Ultimate Guide to Dynamic Pricing

05.03.2024

Transparency in e-commerce: Leading the conversation at Price Points Live 2024

Europe’s e-commerce and pricing event of the year is returning in 2024, as Omnia Retail gears up for another exciting edition of Price Points Live. As leaders in e-commerce pricing across Europe, Omnia Retail is...

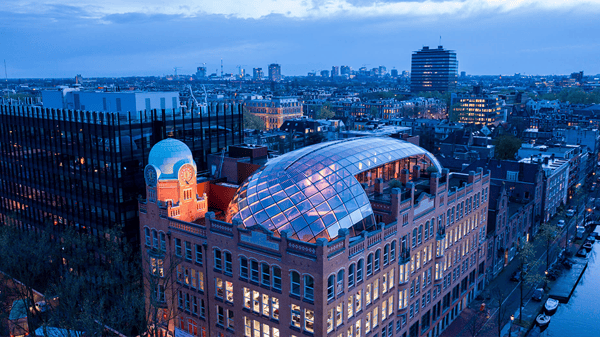

Europe’s e-commerce and pricing event of the year is returning in 2024, as Omnia Retail gears up for another exciting edition of Price Points Live. As leaders in e-commerce pricing across Europe, Omnia Retail is perfectly positioned to bring together experts and leaders in retail, pricing, marketing and branding to share insights and knowledge. Taking place at the modern Capital C building in Amsterdam on 7 March 2024, the building’s majestic glass dome ceiling sets the tone fittingly for this year’s main topic: Transparency. Whether it be transparency in pricing, marketing or e-commerce practices, our panel of speakers bring more than a century of collective knowledge and experience to the table. Joining us is Prof. Hermann Simon, the co-founder and chairman of Simon-Kucher who is returning to Price Points Live for a second visit. Known as the world’s leading expert on pricing and growth consulting, Prof. Simon is an award-winning author. Also on this year’s stage is Natalie Berg - an analyst, author and podcast host - who will add value to the conversation on all things global retail. Dr Doug Mattheus, a business executive and consultant, will be bringing his 35-years of knowledge and experience in marketing, retail and branding. Lastly, Cor Verhoeven is a Group Product Manager at one of Europe's largest marketplaces, Bol.com, specialising in pricing and assortment insights. He’ll be bringing his entrepreneurial spirit and his 10-plus years of e-commerce, product management and marketplace experience to Price Points Live. Our speakers will be brought together by the charming Suyin Aerts, who is also a returning panel member. Challenges in today’s world of e-commerce What are brands and enterprises facing in e-commerce in 2024? From branding to pricing to consumer behaviour, the e-commerce arena has experienced more phases and changes in the last four years that it did in the previous decade. Let’s discuss some of the industry’s key trends and issues as of today. Growing competition and price-war strategies As e-commerce grows and oversaturates each vertical, consumers have more choice and power. This is not necessarily a bad thing, however, it does mean that brands and retailers start employing more competitive pricing strategies that ultimately lead to price wars between competitors and a race to the bottom. This undercuts the value of products and only results in losses for each business involved. This has been evident with smartphone brands like Samsung and Huawei who competitively lower the prices of their smartphones to achieve higher market share. It’s also common between wholesale retailers like CostCo and IKEA or large online marketplaces like Amazon that employ tactics to get their vendors to sell their products lower than on any other marketplace. Increased customer expectations For decades, the relationship between retailers and consumers had been dominated by the former. Customers had only a few options for where they trusted to purchase their groceries, shoes, school supplies, winter essentials and everything in between. Today, that relationship has been flipped on its head as consumers enjoy the pick of the litter in just about every retail vertical. As this trend has developed, consumers have come to expect faster shipping, better prices, higher quality, and more benefits for their loyalty. This will naturally affect a brand or retailer’s pricing strategies as they try to maintain customer retention and even attract new customers with promotions, benefits from loyalty programs and clubs, and bundles that appeal to shoppers. Changing customer loyalty What makes a customer loyal to a brand? At what point does a customer’s loyalty erode? And, what are the factors that could cause this to happen? For most customers, it’s a balancing act between quality and cost. However, in 2024, brands and enterprises must face other factors that could affect customer loyalty: Sustainability efforts. A 2023 McKinsey and NielsenIQ study found that products with ESG claims (environmental, social or governance) accounted for 56% of the total sales growth during the five-year period of the study, from 2017 - mid-2022, showing, for the first time, that brands with some kind of sustainability mention are growing faster than those without. This is all due to changing customer loyalty and the very parameters that shape and shift that loyalty. Social changes may be another factor. For example, in the sporting goods vertical, participation in social sports like pickleball and paddle tennis have increased by 159% while lacrosse, skiing and track declined by 11%, 14% and 11% respectively. Stubborn inflation The issue that has plagued global e-commerce since 2021 is still having its ripple effects on the industry in 2024. In the first quarter of 2024, the EU has already cut GDP growth expectations for the year from 1.3% to 0.9% as interest rates remain high while consumers still grapple with a 40% increase in gas and food prices that peaked in 2023. With this reality, pricing has never been more important nor more sensitive to the consumer. McKinsey’s latest ConsumerWatch report shows that shoppers were buying less items at the end of 2023 compared to the previous year’s period, with personal care dropping 3%, household items dropping 3% and pet care dropping 5% which results in AOV (average order value) loss. The importance of transparency in pricing software The use of dynamic pricing in e-commerce has grown exponentially in the last decade, however, that does not mean every software provider offers the best-in-class platform. Not every pricing tool is made equally. Transparency is something that has not been prioritised as a core tenet of pricing software, which has often allowed for a murky relationship between a brand or enterprise and their own pricing strategies. For a user of pricing software to experience the full potential of a pricing tool, they need to be able to build, test and edit each pricing strategy with clarity and ease. They need to be able to understand how and why a pricing recommendation has been made. They should be physically able to see every pricing strategy simultaneously at play without convolution or confusing coding jargon. While this may seem obvious, some pricing platforms have found that withholding pricing knowledge from a customer is the way to go. How is Omnia enhancing transparency? When Omnia set out to build its new pricing tool, named Omnia 2.0, its main goal was to create a next-generation platform that would enhance a user’s flexibility, user experience and transparency. Why was this necessary? The reason is two-fold: Pricing for SMBs and enterprises can be overwhelming, time-consuming and confusing. For enterprises, as assortments become larger and competitors thicken the competition, pricing may become more complicated. “As the ability to run detailed and complex pricing strategies has become mainstream, it has snowballed into the next level of challenges: Complexity overload,” says Omnia’s CEO Sander Roose. By developing our one-of-a-kind Pricing Strategy Tree™ coupled with information dashboards that give a God-like view of the market and every strategy you have at play, pricing becomes what it should always be: Transparent, flexible and simple. “Omnia 2.0 successfully cuts through the clutter,” says Sander. Another development that enhances transparency for users of Omnia 2.0 is the “Explain Price Recommendation” feature which provides a full explanation of how the price advice of a particular product came to be. This not only enables full control over how and why prices may change but it increases the customer’s pricing maturity. “The ‘Price Explanation’ visually tracks the path through the Tree to show the logic and how the price advice came about,” explains Sander. Join us at Price Points Live 2024 “Although at Omnia we believe it’s still day one in terms of building the ultimate pricing platform we are building towards in the long-term, we are very proud of how the Omnia 2.0 next-generation pricing platform gives our users of and customers ever growing superpowers,” says Sander. Join our exclusive annual event by reserving your seats on our Events page or simply email your dedicated Customer Success Manager who will assist you. We’ll be seeing you in Amsterdam!

Transparency in e-commerce: Leading the conversation at Price Points Live 2024

14.02.2024

How to Use Markdowns to Manage Stock throughout the Product Life Cycle

Any e-commerce seller knows how tricky markdowns can be. You don’t want to markdown stock too early when it could be selling at a higher price, but you also don’t want to markdown too late and end up with old stock you...