Preparing early for Black Friday is essential for retailers looking to maximise sales and stay competitive in a dynamic market. By planning ahead, retailers can strategically adjust pricing, manage inventory and fine-tune marketing campaigns to attract more customers. This proactive approach enables the identification of key product and market trends, ensuring that promotions are both timely and effective. In addition, early preparation helps to mitigate potential logistical challenges, such as stock shortages or delivery delays, which can negatively impact customer satisfaction. Finally, preparation enables retailers to navigate the complexities of dynamic pricing and price monitoring, ensuring that they can capitalise on increased consumer activity during this peak shopping period.

In our recent research, we looked at data from the sports fashion and electronics industries in the Dutch and German markets from 2018 to 2023. The analysis focused on products with price deviations and consistent data streams, providing insights into dynamic pricing, price monitoring and pricing strategies during the Black Friday period.

Key findings

1) Early start of Black Friday promotions

Our research shows that Black Friday promotions start 10 days before the actual event. This early start continues through the weekend, creating a highly competitive environment. Retailers start lowering prices as early as mid-October, with the biggest discounts occurring on Black Friday and continuing through the weekend. Chart 1: Timeline before, during and after Black Friday. Retailers begin lowering prices as early as mid-October, with the most significant discounts occurring on Black Friday and continuing through the weekend.

Chart 1: Timeline before, during and after Black Friday. Retailers begin lowering prices as early as mid-October, with the most significant discounts occurring on Black Friday and continuing through the weekend.

2) Post-Black Friday price trends

Prices tend to return to pre-Black Friday levels, but gradually decline towards Christmas and beyond. This trend indicates a continuous price decline, influenced by the dynamic pricing strategies employed during the festive season.

3) Impact of the Omnibus ruling

The European Union's omnibus ruling in 2022 significantly changed promotional strategies. By 2023, the impact of the ruling was evident as retailers adjusted their pricing tactics to comply with the new regulations. This change disrupted the typical product lifecycle, particularly during the Black Friday period.

Talk to one of our consultants about dynamic pricing.

Prepare with 3 key actions to gain a competitive advantage on Black Friday

To maximise your competitive advantage this Black Friday, focus on three essential actions before you start your strategies: Identify key players, analyse key products and evaluate key areas.

By mastering these three areas, you can create a robust strategy that leverages your competitive advantage and drives success during the Black Friday period.

1) Identifying Key Players

One of the first steps is to identify the key players in your market. This process is critical to understanding competitive dynamics and ensuring that your pricing strategies are effective.

Questions to ask:

- Which retailers are price competitive?

- How often do the key players change their prices?

- How do the promotional strategies of key players differ from ours?

- How often should we review and update our blacklist of unreliable offers?

- The Price Ratio Variance benchmark allows you to measure the consistency of offers against your current selling price. You can use this metric to assess which key players you should - or should not - focus on in your Black Friday pricing rules. A higher variance indicates greater inconsistency and less uniformity in offers.

- To ensure the accuracy of our analysis , a recently released new feature that blacklists offers identified as outliers or those with unreliable stock information helps to maintain a more normalised view of the market, especially during the Black Friday period.

2) Analysing Key Products

The next step in your preparation is to analyse key products. This is essential to identify significant price variation and understand how competitors are pricing similar items.

Identify products with significant price variation per area by analysing the Price Stability Score:

- Assess how closely your competitors' prices match your own. A score of 100 indicates identical pricing, while a score of 0 means there are significant price differences. By monitoring these scores on a daily basis, you can see which products are moving within their promotions.

Top 10 Performers (Slice 1): The Price Stability Score helps you to find out at a glance to what extent your prices for products overlap with those of your relevant competitors.

Top 10 Performers (Slice 1): The Price Stability Score helps you to find out at a glance to what extent your prices for products overlap with those of your relevant competitors.

When preparing for Black Friday, it’s important to focus on products with significant price deviations. By filtering dashboards based on the lowest price stability scores, you can identify the most volatile items and plan your promotions accordingly.

3) Evaluating Key Domains

When preparing for Black Friday, it’s important to focus on products with significant price deviations. By filtering dashboards based on the lowest price stability scores, you can identify the most volatile items and plan your promotions accordingly.

Finally, evaluating key domains is crucial for determining where to focus your marketing spend and promotional efforts. This involves analysing the lowest unit prices across different markets and making informed decisions about where to allocate resources. Within the Omnia software, you can analyse relevant marketplaces and domains by examining the lowest unit price. By identifying the cheapest unit price, we can determine the most effective domain for promotions. If the goal is to offer the product for €20, it makes sense to focus on Kieskeurig, where the price aligns with this target. Conversely, it would be less effective to promote on Tweakers, where the price is significantly lower at €14.79.

By identifying the cheapest unit price, we can determine the most effective domain for promotions. If the goal is to offer the product for €20, it makes sense to focus on Kieskeurig, where the price aligns with this target. Conversely, it would be less effective to promote on Tweakers, where the price is significantly lower at €14.79.

By combining various dashboards in your price monitoring software, you can gain a comprehensive understanding of market dynamics and better prepare for Black Friday. This holistic approach allows you to navigate the complexities of dynamic pricing and develop effective pricing strategies that enhance your competitive edge.

Top 4 strategy ideas to make a success of Black Friday

Once the market is understood and you know how you are positioned in the market, the next step is to see what kind of strategies you can implement in your Pricing Strategy Tree in Omnia during Black Friday.

1) Follow the Price Movement in the Market

As Black Friday approaches, retailers have begun lowering their prices 10 days in advance. This early discounting is part of a dynamic promotion strategy across different assortments.

To effectively track market movements ahead of Black Friday, it's important to include promotional products during the Black Friday period itself. You can still follow market prices to be competitive while ensuring that the cheapest price will be the promotional price during the promotional period. This allows for a comprehensive understanding of price trends and competitive positioning.

Several conditions can be used in combination:

- Stock age: Adjust prices based on how long products have been in stock.

- Selected competitors: Monitor and compare prices with only selected competitors.

- Sales Through Rate: Consider the rate at which products are sold to adjust prices accordingly.

2) Promotional price for X units only

We often see that in the lead up to Black Friday, companies tend to send out brochures, newsletters and promote some products with special prices on their various marketing channels. These are usually products that are popular in the market, some bestsellers or high runners that have good demand and will attract people to come to your websites when you have good deals on them and hopefully also drive sales of the other complementary products that are on the websites.

Sometimes you also have a limit to this especially good price and hence, only want this price to be for X number of units sold. This can be translated into the following pricing rule: Special price only for X units sold, after which it will follow the market prices with assigned safety rules.

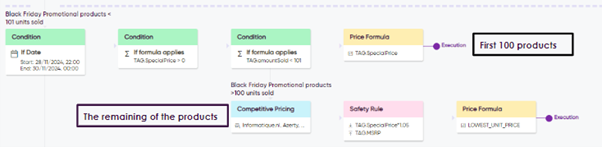

Pricing Strategy Tree: On the 29th of November (Black Friday 2024), only the first 100 units of the products with assigned special/ promotional prices, will have the promotional price and once it reaches 100, the next price will follow the lowest price of the selected competitors with a minimum boundary of the promotional price/ special price + 5% and a maximum boundary of the MSRP/RRP

3) Avoid Price War

Rather than always following the cheapest, identify the situations in which you want to follow the market down. During promotional periods such as Black Friday, it may be strategic to adjust prices temporarily to remain competitive. For example, you may only lower your prices and follow the market down (with respect to a minimum price boundary) under certain conditions, such as when stock reaches a certain age or when there are a defined number of competitors in the market.

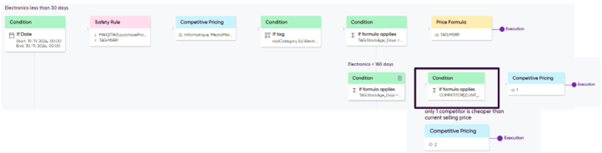

Pricing Strategy Tree: From 19th of November, for the Electronics products, depending on their stock age, the price is following the cheapest price amongst the selected competitors with minimum safety price and maximum price ONLY IF there are at least 2 of these selected competitors with prices lower than your current selling price.

4) Strategic Price Adjustments post Black Friday

The price decrease and increase before and after black friday have bigger scale than the other normal period. Follow the market as retailers start increasing their prices post Black Friday but at a steady rate to avoid too big of price fluctuations. By adjusting prices with a stabilised increase, retailers can ensure a smoother transition to post-Black Friday pricing, maintaining customer confidence and business stability.

Example of how this can be translated into a pricing rule:

From 30th November until the end of Cyber Monday, follow the average price in the market among selected competitors, but in case of sharp price increases, limit the increase to max. 5% with a maximum of MSRP/RRP and a minimum of either promotional price or minimum margin.

Conclusion: Optimise your Black Friday strategy and save time with Omnia's pricing software

At Omnia, we aim to empower you with the ability to gather and analyse these insights independently. Our new tool allows you to slice and dice the data using different benchmarks, giving you a comprehensive view of how dynamic pricing and price monitoring can be applied in your industry.

- Benchmark against competitors: Compare your pricing strategies with competitors to identify areas for improvement.

- Analyse seasonal trends: Understand how seasonal events such as Black Friday impact your pricing and adjust your strategies accordingly.

- Regulatory compliance: Ensure that your pricing strategies comply with regulations such as the Omnibus Directive.

With these insights and more, you can navigate the complexities of dynamic pricing and develop effective pricing strategies that increase your competitive advantage.

Read more about interesting pricing strategies here:

- What is Dynamic Pricing?: The ultimate guide to dynamic pricing.

- What our the best pricing strategies?: Read about 17 pricing strategies for you as a retailer or brand.

- What is Price Monitoring?: Check out everything you need to know about price comparison and price monitoring.

- What is Value Based Pricing?: A full overview of how price and consumer perception work together.

- What is Charm Pricing?: A short introduction to a fun pricing method.

- What is Penetration Pricing?: A guide on how to get noticed when first entering a new market.

- What is Bundle Pricing?: Learn more about the benefits of a bundle pricing strategy.

- What is Cost Plus Pricing?: In this article, we’ll cover cost-plus pricing and show you when it makes sense to use this strategy.

- What is Price Skimming?: Learn how price skimming can help you facilitate a higher return on early investments.

- What is Map Pricing?: Find out why MAP pricing is so important to many retailers.

.png?height=766&name=ORA%20Visuals%2020252026%20(11).png)