Price Points by Omnia Retail

19.04.2024

Reflecting on Price Points Live: Lessons for e-commerce in 2024

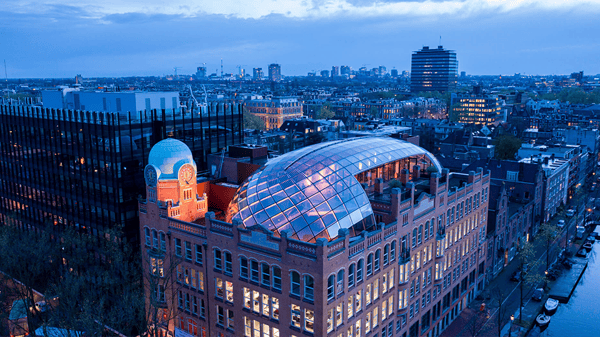

It’s been a few weeks since Europe’s e-commerce and pricing event of the year, produced and hosted by Omnia Retail, took Amsterdam by storm at the modern Capital C building in early March. Our invited guests were on the...

It’s been a few weeks since Europe’s e-commerce and pricing event of the year, produced and hosted by Omnia Retail, took Amsterdam by storm at the modern Capital C building in early March. Our invited guests were on the receiving end of the knowledge and expertise of some of the e-commerce world’s greatest minds and leaders, making for a successful annual rendition of Price Points Live. On this year’s stage was Prof. Hermann Simon, the co-founder and chairman of Simon-Kucher, who was a returning speaker at Price Points Live. He is known as the world’s leading expert on pricing and growth consulting. Also on the stage was Natalie Berg, an analyst, author and podcast host; Dr Doug Mattheus, a business executive and consultant in marketing, retail and branding; Gerrie Smits, a business consultant, speaker and author, and lastly, Cor Verhoeven, Group Product Manager at Bol, specialising in pricing and assortment insights. To conclude, the warm and confident Suyin Aerts returned as our host. Whether it be transparency in pricing, marketing or e-commerce practices, our panel of speakers bring more than a century of collective knowledge and experience to the table. So, what did our guests learn and take away from each of our speakers? What can brands and retailers understand about pricing, consumer behaviour and branding? Omnia shares the insights and knowledge pertinent to e-commerce success in 2024. Natalie Berg: E-commerce author and analyst “We are living in a perpetual state of disruption, and retail is no stranger to this, but the past few years have seen unprecedented levels of volatility and uncertainty,” shared Natalie. Whether we want to call it disruption, a seismic shift or a geopolitical and socio-economic tsunami, the one mitigating force to today’s ecommerce landscape was - and still is - Covid-19. “Covid has digitised our world - the way we live, the way we shop, or the way we exercise. And when it comes to shopping, most of it is still done in a brick-and-mortar store, but the majority of these sales are digitally influenced,” shares Natalie. This has brought brands and retailers to the popular omnichannel strategy, which has become more and more common and necessary. However, Natalie predicts that retail will start moving from omnichannel to ‘unified commerce’ which is “not just about being present in those channels but centralising those operations and connecting everything in real-time,”.. We see this already taking place with the partnership that shocked the e-commerce world in 2023 when Meta and Amazon announced that Meta users can shop Amazon products without even having to exit their Instagram or Facebook apps, creating a centralised and synonymous experience for social commerce and marketplaces’ shoppers. She goes on to speak about the customer’s time and how much more precious it is going to become for e-commerce and retail leaders. “28% of Amazon purchases take place in three minutes or less,” she stated,” so if you’re not saving a customer’s time, you have to be enhancing it.” A customer’s tolerance for mediocrity or for average service or experiences is getting lower and lower, which is how the customer experience has become the new currency. “It’s about really wowing your customers. Going beyond! Disrupting the status quo.” She shares that a new phenomenon is taking place because of this refreshed focus on the customer experience: The democratisation of white-glove service. “It’s a technology that is helping brands and retailers give this level of service,”.. This includes Walmart, in the US, which will go into your home to stock your kitchen with your newly purchased groceries while other retailers will collect your returns from your house when they make delivery, allowing the customer to kill two birds with one stone. Adidas in London has installed a system called “Bring it To Me” in change rooms where, if you want an item that’s in a different colour or size, a store assistant can collect it for you without you having to leave the change room. “Tech-enabled human touch - that’s what will separate the retailer winners from the retail losers,” Natalie argues. To conclude, Natalie speaks on how the use of AI will empower both e-commerce players and customers when shopping. “In the future, we won’t know where the physical world ends and the digital one begins,” giving an eerie yet exciting conclusion. “As a brand or retailer, standing still is the most dangerous thing you can do.” Dr Doug Mattheus: Consultant and branding expert Hailing from South Africa and living in the UK is Dr Doug Mattheus whose presentation focused on the art and science of brand building. So, what makes a brand long-lasting? “It is a mix of tangible and intangible features that, if properly managed, creates influence and generates value,” says Doug. But, as we’ve seen brands rise and fall over the last few decades, what are some of the factors that have created the most valuable brands in the world, from Apple to Mercedes Benz to Walmart? Creating a brand hook The ways in which a customer can get hooked on a brand are limitless: Reflecting back to the time he received his first pair of Nike shoes in high school, the one item Doug cared about keeping just as much as the shoes themselves was the box they came in. “It wasn’t just a box - it was a Nike box.” Fast-forward to adulthood, he visited a Harrods store and witnessed customers buy empty single-use packets and bags with the Harrods logo on them. In a more recent case, the fragrance of bath bombs and body scrubs in the air at a mall or airport has become one that is synonymous with LUSH. “Just follow your nose,” says Doug. “So, what is your brand hook?” On the contrary, we see brands like The Body Shop that have struggled to keep up with digitally-native challenger brands like Drunk Elephant, Glossier and Paula’s Choice in the personal care market and is undergoing mass closures across the US and EU. Doug’s advice to brands is to create a unique hook - whether it be in the sights, smells, sounds or physical world. What’s your differentiator from competitors? A small player in the award-winning wine industry in South Africa is a vineyard called Vergenoegd Wine Estate. By a large stretch, it is not the most well-known or award-winning brand. However, this boutique vineyard did not refrain from harnessing the commercial value of organic farming. The winemakers introduced runner ducks to the vineyard, which roamed around eating worms, snails, and bugs that could be detrimental to the vines. In addition, these ducks became a tonic for families and couples with kids wanting to experience the vineyard while having something fun for children. The ducks have become a unique feature to Vergenoegd Wine Estate and a key driver of foot traffic and revenue. “This is a great example of how a small player is not being defined by its smallness and not being intimidated by bigger players.” Multiple touchpoints for customers Stemming from Natalie’s thoughts on brands having to go the extra mile to impress customers, Doug shares that there are moments of magic around us at all times, and it is up to business leaders to find and develop those moments. However, where there is ease and innovation between brands and customers (like at Nordstrom in Seattle, USA who did not want to lose their “eyeball moments” with customers from rapid digitalisation, began offering curbside pick-up so they can still have face-to-face interactions with shoppers), there are also moments of friction and time-wasting that cause frustration for customers. It’s about fine-tuning interactions and creating moments that make a brand memorable. Relevance: Do you reinvent like a butterfly or a bull? As the title suggests, brands in many verticals, but especially in fashion, personal care, sporting goods, fitness, and electronics, are faced with the rapid rise of digitally-native brands that exist to challenge the status quo. In fact, these brands, which have only known a digital world, are, in fact called “challenger brands” because of the innovative approach to design, production, supply chains, customer interactions, marketing, and everything under the e-commerce sun. According to Doug, brands who reinvent like a butterfly are those who can go with the changes and challenges in front of them with agility and resilience while those who face reinvention like a bull may be stubborn and ignorant and may face their own downfall. Cor Verhoeven: Group Product Manager at Bol. Coming from one of Europe’s largest and most successful marketplaces, Bol., Cor Verhoeven delved into pricing, specifically how Bol. tackles bad prices on the platform and what the negatives are for a marketplace or e-commerce brand. “We have 38 million items for sale, 13 million active customers, and 50,000 unique selling partners. That means almost every home in the Netherlands and Belgium has bought something from Bol.,” says Cor. With numbers like that, it’s more than possible that a marketplace would run into pricing issues. “Part of our strategy is to make Bol. an equal playing field. Our sellers must be able to make a living off what they sell on Bol. - it’s not just us that needs to do well.” So, how does a customer-centric pricing strategy fall into this? “We all work hard to make sure that the price of an item is not the reason someone doesn’t buy something on Bol.,” says Cor. “Pricing is important because it positions you in a competitive market, it establishes customer trust, and it establishes customer lifetime value. Our success is caused by growth, monetising and retaining in a loop,” explained Cor. “Our three main beliefs when it comes to pricing are High-quality deals, trustworthy and reliable prices, and competitive prices in line with the market.” The balancing act between insult pricing and best-in-market pricing is tricky and precarious, which is why Bol. judges their products on their prices. “If a product’s price is above an allowable price, we take it offline to product the customer,” Cor stated. How does Bol. decide on what is an allowable price? “We source benchmarks. If a product has a benchmark, it’s given a classification - an insult price or an allowable price - and business rules are set,” explained Cor. “When we don’t have a price benchmark, that’s when we have little control.” When Bol. doesn’t have a price benchmark for a product, they utilise their data science model to predict a price while, daily, the model is manually looking for prices to benchmark those products.” The result is a price for a product that is more aligned with the market and within the boundaries of what a customer will accept. “Of course, taking insult prices offline decreases revenue, but what we get back in return is way bigger. The seller sees increased conversion,” said Cor. Sander Roose: CEO and Founder of Omnia Retail Joining the panel was our very own CEO Sander Roose who started his keynote speech by making good on a promise. “At the last Price Points Live event, I promised that Omnia would release a new platform sometime in 2023, and the whole Omnia team is proud to have achieved that.” As a veteran in the dynamic pricing industry, with 12 years at the helm of Omnia Retail, Sander brought to the stage what he believes are the pricing elements and design principles of successful dynamic pricing. According to Sander, there are three factors to successful dynamic pricing implementations: Clearly defined objectives; securing engagement and support; and the spirit of continuous learning. “Without clear objectives, you can have a strong pricing platform, but you won’t know how to harness it,” he said. “And as the market changes, you need to be able to change your objectives.” For the second factor, pricing managers and teams need to be fully on board: “If they don’t understand how prices are calculated, they will reject the implementation as a whole.” Then, the third factor speaks to a dynamic pricing user's ability to be agile and curious: “We see that customers that used the system most intensively to make iterations with their prices get the best results.” As a result, Omnia found that two key design principles for dynamic pricing success are necessary: flexibility and transparency. “Being able to automate any pricing strategy you can think of, to facilitate all the objectives, to keep control while the system is on autopilot, and finally, making sure the users are adopting the system.” Flexibility and Transparency A pricing platform needs to be able to support a vast array of pricing objectives and strategies. “A platform needs to be able to endure various high-level objectives. Perhaps on a global level, you have a profit maximisation objective while the strategy on lower levels, such as on a per country basis, may be different,” explained Sander. “For example, if your global brand has just launched in the Netherlands, you may want to maximise market share. Then, even further down, depending on your various verticals, you may want a stock-based strategy.” Flexibility must also be present not just in pricing strategies but in data collection and the recalculation process. Using the example of a Tesla self-driving car with a blacked-out windscreen, Sander makes the point that customers of dynamic pricing still need to be able to see and understand what’s going on - even if the system is on autopilot: “If you create transparency while the system is on autopilot, you can create buy-in from internal stakeholders and facilitate learning loops.” How flexibility and transparency exist in Omnia 2.0 The culmination of these two values resulted in the Pricing Strategy Tree, developed specifically for Omnia 2.0, making strategy building and interpretation easier and faster. “The copy-and-paste feature means a large D2C brand that wants to launch in a new country can simply execute their entire pricing strategy with just a few clicks by copying the strategy in the tree from another country. This is huge for an international customer to be able to do this.” Another feature called Path Tracking allows you to visually see how your strategy came to be, step by step. “This feature helps to validate if you set up the tree how you intended to,” explained Sander. Another feature that elevates transparency is Strategy Branch Statistics which works to answer burning questions from pricing managers: ‘Which part of my strategy is most impactful? The Strategy Branch Statistics feature works to show you which business rules are doing the work to give your prices.’ An additional feature highlighting transparency is the ability to name branches within the tree. The names not only help coworkers understand what you’ve built, but they differentiate the various strategies that are at play at the same time. Strategy Branch Statistics feature works to show you which business rules are doing the work to give your prices.’ An additional feature highlighting transparency is the ability to name branches within the tree. The names not only help coworkers understand what you’ve built, but they differentiate the various strategies that are at play at the same time. AI in pricing “From private label matching, creating automated weekly reports to send to category managers, to automated insights, AI is a powerful technology that has the potential to contribute to the superpowers we offer customers,” says Sander. However, as of today, Sander believes that AI is one part of the machine and should not be considered the holy grail of price setting. “The true need is goal-based pricing,” Sander says.”AI is a means and not an end.” Sander's vision for AI in Omnia’s pricing platform sees a move from granular pricing strategies that affect the business’s objectives to a scenario where the customer sets the objective, and the Omnia platform automates and optimises prices. “We want to move more and more towards goal-based pricing in our platform. We believe the end game for price automation will be rules and AI, not just AI, and the Pricing Strategy Tree allows for a rules and AI combination.” Prof. Hermann Simon: Founder of Simon-Kucher, author As a world-renowned expert in pricing and consulting, Prof. Hermann Simon joins the panel to share what he thinks are the hidden champions in e-commerce and retail and what their successful strategies are. Specifically, the small and midsized global market leaders with a market share of above 50% and that are little known to the public. “In China, which is by the largest global exporter, 68% of the exports come from small and midsized companies, and behind this number are the hidden champions,” says Hermann. “Inside super export performance requires large companies plus a very strong mid sector. Hidden champions, not large corporations, determine whether a country really excels in global competition. Hidden champions are an untapped treasure to learn about business success.” Focus and Globalisation What characterises these companies? “The three pillars of the hidden champion’s strategy are ambition, focus, and globalisation fueled with the tools of innovation, value and price,” shares Hermann. Focusing on your product makes your market small. How does hidden champions enlarge their market? An example of successful globalisation is Karcher, the global leader in high-pressure water hoses, which began internationalisation in the 1970s slowly and then accelerated in the 90s to become the global market share leader at 70%. Other examples include Deichmann, the largest shoe retailer in Europe, which sits in 31 countries across Europe, Africa, the Middle East and the US. “The lesson here is that if you have a good product, multiply it by regional expansion,” says Hermann. Value and Price For successful companies, value comes from innovation and a closeness to the customer. But what drives innovation? The answer is different for hidden champions and the average company. Below is a pie chart where we can see how little an average company prioritises customer needs: What is the most important aspect of pricing? “It’s customer-perceived value. The willingness to pay is a mirror of perceived value, and therefore, value equals price,” explains Hermann. “Understanding, creating and communicating values are the key challenges in pricing.” Using the example of the iPhone, the cost has always been above the market average for a smartphone, yet the success of the product indicates it must obviously bring value to the customer. “Value drives price,” concludes Hermann. According to internal studies at Simon Kucher, only one-third of companies can say they have real pricing power. So, two-thirds are exposed to the sensitivities of the customer. “The result is that value-to-customer and pricing power is created by differentiating your product, changing the way customers perceive your products and your price, and changing the mindset and confidence of your own people in your company,” says Hermann. Closeness to customer “88% of hidden champions say that closeness to the customer is their biggest strength, even more than technology,” says Hermann. Simon-Kucher found that 38% of employees at hidden champion companies had regular contact with customers, while large corporations only had 8%. In retail, it is difficult to understand value perception because there are many competitors selling the same thing. This makes retail’s soft parameters, such as the store layout, service and friendliness, more helpful in understanding value perception. The challenge then becomes how do enterprises effectively communicate their value offering. “Hidden champions are true value leaders with their intense closeness to customers. They achieve a more profound understanding of a customer's needs; their continuous innovations create higher value, and they integrate customer needs and technology much better than the average company.” Gerrie Smits: Speaker and author Gerrie believes we’re getting customer-centricity all wrong. From his 25-plus years of experience in helping companies prioritise customers as well as how to deal with the changing digital world, he has found a common thread of issues: “Technology is getting in the way, companies are seeing customers as a target, and teams are siloing their responsibilities and not wanting to take on other responsibilities,” says Gerrie. “Companies are getting tech just for the sake of it, not because there is any use for it. If you’re going to invest in tech, make sure you have a competitive edge.” According to US business leaders, the number one skill a company needs to have to succeed in the digital world is empathy. “Technology is fantastic if you know what to do with it. My clients are driven by technology, and that’s not customer-centric.” When it comes to companies seeing customers as a target. “I’ve never met a company that doesn’t say they’re customer-centric - obviously,” says Gerrie. But there is a large difference between intent and action. “For example, Amazon has always said they are obsessed with understanding the customer. Yet still, they got it wrong when, in 2022, they reportedly lost $10 billion from dismal sales for their voice-activated Echo. “What brands need to understand is that there is only a small part of me that is your customer. The rest is me as a human being,” says Gerrie. “Seeing your audience as buyers, you are not fulfilling the whole potential.” Concluding Price Points Live 2024 In closing, our panel speakers joined Suyin on stage to answer a round of interesting questions and to share their final thoughts. “To drive loyalty, one must understand what your customers value,” said Natalie, while Doug shared that although pricing is vital to brand loyalty, it is not the only factor. Answering a question about how smaller players in e-commerce can grow and succeed against large enterprises, Natalie says, “It’s like Prof. Hermann said: It’s about focus. You have to know what your strengths are, and then you have to execute really well.” The world of e-commerce is set to make $6.3 billion in global sales in 2024, which is expected to increase to $8 billion in 2027. However, what’s more interesting is the amount of e-commerce users which is set to increase to 3.2 billion by 2029 - a third of the current world population. More shoppers don’t necessarily mean more revenue and sales, so it is safe to say that brands and retailers need to focus their efforts on pricing, innovation, unique marketing and frictionless experiences if they want a segment of the ever-growing pool of e-commerce users. With these insights and go-to strategies for elevating the success of brands and enterprises, Omnia is excited to see what the e-commerce landscape will be for our customers and other growing e-commerce companies. We’d like to thank all of our speakers - Natalie Berg, Dr Doug Mattheus, Prof. Hermann Simon, Gerrie Smit, Cor Verhoeven and our own Sander Roose - and our host, Suyin Aerts, for their knowledge and time spent at Price Points Live 2024. Watch keynote presentations here.

Reflecting on Price Points Live: Lessons for e-commerce in 2024

05.03.2024

Transparency in e-commerce: Leading the conversation at Price Points Live 2024

Europe’s e-commerce and pricing event of the year is returning in 2024, as Omnia Retail gears up for another exciting edition of Price Points Live. As leaders in e-commerce pricing across Europe, Omnia Retail is...

Europe’s e-commerce and pricing event of the year is returning in 2024, as Omnia Retail gears up for another exciting edition of Price Points Live. As leaders in e-commerce pricing across Europe, Omnia Retail is perfectly positioned to bring together experts and leaders in retail, pricing, marketing and branding to share insights and knowledge. Taking place at the modern Capital C building in Amsterdam on 7 March 2024, the building’s majestic glass dome ceiling sets the tone fittingly for this year’s main topic: Transparency. Whether it be transparency in pricing, marketing or e-commerce practices, our panel of speakers bring more than a century of collective knowledge and experience to the table. Joining us is Prof. Hermann Simon, the co-founder and chairman of Simon-Kucher who is returning to Price Points Live for a second visit. Known as the world’s leading expert on pricing and growth consulting, Prof. Simon is an award-winning author. Also on this year’s stage is Natalie Berg - an analyst, author and podcast host - who will add value to the conversation on all things global retail. Dr Doug Mattheus, a business executive and consultant, will be bringing his 35-years of knowledge and experience in marketing, retail and branding. Lastly, Cor Verhoeven is a Group Product Manager at one of Europe's largest marketplaces, Bol.com, specialising in pricing and assortment insights. He’ll be bringing his entrepreneurial spirit and his 10-plus years of e-commerce, product management and marketplace experience to Price Points Live. Our speakers will be brought together by the charming Suyin Aerts, who is also a returning panel member. Challenges in today’s world of e-commerce What are brands and enterprises facing in e-commerce in 2024? From branding to pricing to consumer behaviour, the e-commerce arena has experienced more phases and changes in the last four years that it did in the previous decade. Let’s discuss some of the industry’s key trends and issues as of today. Growing competition and price-war strategies As e-commerce grows and oversaturates each vertical, consumers have more choice and power. This is not necessarily a bad thing, however, it does mean that brands and retailers start employing more competitive pricing strategies that ultimately lead to price wars between competitors and a race to the bottom. This undercuts the value of products and only results in losses for each business involved. This has been evident with smartphone brands like Samsung and Huawei who competitively lower the prices of their smartphones to achieve higher market share. It’s also common between wholesale retailers like CostCo and IKEA or large online marketplaces like Amazon that employ tactics to get their vendors to sell their products lower than on any other marketplace. Increased customer expectations For decades, the relationship between retailers and consumers had been dominated by the former. Customers had only a few options for where they trusted to purchase their groceries, shoes, school supplies, winter essentials and everything in between. Today, that relationship has been flipped on its head as consumers enjoy the pick of the litter in just about every retail vertical. As this trend has developed, consumers have come to expect faster shipping, better prices, higher quality, and more benefits for their loyalty. This will naturally affect a brand or retailer’s pricing strategies as they try to maintain customer retention and even attract new customers with promotions, benefits from loyalty programs and clubs, and bundles that appeal to shoppers. Changing customer loyalty What makes a customer loyal to a brand? At what point does a customer’s loyalty erode? And, what are the factors that could cause this to happen? For most customers, it’s a balancing act between quality and cost. However, in 2024, brands and enterprises must face other factors that could affect customer loyalty: Sustainability efforts. A 2023 McKinsey and NielsenIQ study found that products with ESG claims (environmental, social or governance) accounted for 56% of the total sales growth during the five-year period of the study, from 2017 - mid-2022, showing, for the first time, that brands with some kind of sustainability mention are growing faster than those without. This is all due to changing customer loyalty and the very parameters that shape and shift that loyalty. Social changes may be another factor. For example, in the sporting goods vertical, participation in social sports like pickleball and paddle tennis have increased by 159% while lacrosse, skiing and track declined by 11%, 14% and 11% respectively. Stubborn inflation The issue that has plagued global e-commerce since 2021 is still having its ripple effects on the industry in 2024. In the first quarter of 2024, the EU has already cut GDP growth expectations for the year from 1.3% to 0.9% as interest rates remain high while consumers still grapple with a 40% increase in gas and food prices that peaked in 2023. With this reality, pricing has never been more important nor more sensitive to the consumer. McKinsey’s latest ConsumerWatch report shows that shoppers were buying less items at the end of 2023 compared to the previous year’s period, with personal care dropping 3%, household items dropping 3% and pet care dropping 5% which results in AOV (average order value) loss. The importance of transparency in pricing software The use of dynamic pricing in e-commerce has grown exponentially in the last decade, however, that does not mean every software provider offers the best-in-class platform. Not every pricing tool is made equally. Transparency is something that has not been prioritised as a core tenet of pricing software, which has often allowed for a murky relationship between a brand or enterprise and their own pricing strategies. For a user of pricing software to experience the full potential of a pricing tool, they need to be able to build, test and edit each pricing strategy with clarity and ease. They need to be able to understand how and why a pricing recommendation has been made. They should be physically able to see every pricing strategy simultaneously at play without convolution or confusing coding jargon. While this may seem obvious, some pricing platforms have found that withholding pricing knowledge from a customer is the way to go. How is Omnia enhancing transparency? When Omnia set out to build its new pricing tool, named Omnia 2.0, its main goal was to create a next-generation platform that would enhance a user’s flexibility, user experience and transparency. Why was this necessary? The reason is two-fold: Pricing for SMBs and enterprises can be overwhelming, time-consuming and confusing. For enterprises, as assortments become larger and competitors thicken the competition, pricing may become more complicated. “As the ability to run detailed and complex pricing strategies has become mainstream, it has snowballed into the next level of challenges: Complexity overload,” says Omnia’s CEO Sander Roose. By developing our one-of-a-kind Pricing Strategy Tree™ coupled with information dashboards that give a God-like view of the market and every strategy you have at play, pricing becomes what it should always be: Transparent, flexible and simple. “Omnia 2.0 successfully cuts through the clutter,” says Sander. Another development that enhances transparency for users of Omnia 2.0 is the “Explain Price Recommendation” feature which provides a full explanation of how the price advice of a particular product came to be. This not only enables full control over how and why prices may change but it increases the customer’s pricing maturity. “The ‘Price Explanation’ visually tracks the path through the Tree to show the logic and how the price advice came about,” explains Sander. Join us at Price Points Live 2024 “Although at Omnia we believe it’s still day one in terms of building the ultimate pricing platform we are building towards in the long-term, we are very proud of how the Omnia 2.0 next-generation pricing platform gives our users of and customers ever growing superpowers,” says Sander. Join our exclusive annual event by reserving your seats on our Events page or simply email your dedicated Customer Success Manager who will assist you. We’ll be seeing you in Amsterdam!

Transparency in e-commerce: Leading the conversation at Price Points Live 2024

08.02.2024

Omnia’s work on company culture takes centre stage in Frankfurt, Germany

“Even if you don't manage company culture, a specific culture will emerge. Although it probably won't be the culture you envisioned,” says Omnia Retail’s COO Vanessa Verlaan who presented on the topic of building a...

“Even if you don't manage company culture, a specific culture will emerge. Although it probably won't be the culture you envisioned,” says Omnia Retail’s COO Vanessa Verlaan who presented on the topic of building a strong and healthy workplace culture at the annual World Class Workforce Transformation conference in Frankfurt, Germany in January. In sharing Omnia’s experiences, failures and successes in building a healthy company culture, Verlaan shared that it is not something that can be achieved if only one part of the company is actively trying to enforce it: “I am convinced everyone in the company should be responsible of company culture. Not just HR. It starts with the leadership team and then it can be scaled.” Covid-19 has upended how leaders interact with employees and how coworkers connect with each other," a Harvard Business Review article by Denise Lee Yohn says. "Culture has become a strategic priority with an impact on the bottom line. It can’t just be delegated and compartmentalised anymore,” says Yohn. In many cases, a company’s core values are used to attract and hire top talent and remain a calling card on a company’s website. But what happens when the experience does not match the initial expectation? “People have certain expectations when they start at a company and then when faced with the reality, they are disappointed, and then leave. That’s when companies have to rehire for the same positions. This is why core values need to be implemented from the leadership team and throughout each department,” shares Vanessa. Using this simple yet effective system, Verlaan explains how the expectation-reality gap can be closed if culture plays an unconditional role in every step of the employee life cycle: Professionals from DHL Express, Siemens, Allianz Global Investors and Celltrion Healthcare also shared presentations on upskilling, digital transformation in the workplace, employee engagement, and other interesting topics that affect teams across the continent, making this one of the most innovative and forward-thinking events dedicated to the employee experience. In addition to the case study presentation, Verlaan also participated in a roundtable discussion with professionals from other private companies which further unpacked the topic for employees at corporations, scale-ups and start-ups. In talking to one of the fellow speakers who experienced that her previous leadership team was not supportive of implementing a specific workplace culture throughout the company, Vanessa believes that there are further opportunities regarding the practices for companies that want to achieve a strong and positive corporate culture. “Culture persists only because people act in ways that uphold its principles and codes,” says a Stanford Social Innovation Review paper, echoing the sentiment that Vanessa shared in her presentation. As Omnia has grown over the years, expanded in locations and developed each department, one thing has stayed the same - its core values. “We don’t update our core values because they are the foundation. However, they have become more clear and implemented in various steps,” says Vanessa. Omnia Retail's COO Vanessa Verlaan enjoyed snapping some photos at the event with fellow speakers in between interesting discussions on company culture.

Omnia’s work on company culture takes centre stage in Frankfurt, Germany

18.01.2024

The Future of Retail: Navigating E-commerce Trends and Innovations in 2024

E-commerce had a volatile 2023. From declining sales in luxury to behemoth partnerships to the resurgence of influencer marketing, the last 12 months experienced several changes and surprises that even the analysts were...

E-commerce had a volatile 2023. From declining sales in luxury to behemoth partnerships to the resurgence of influencer marketing, the last 12 months experienced several changes and surprises that even the analysts were not expecting. Reflecting on the performance and strategies of social commerce platforms, brands and marketplaces in 2023 has set the scene for a fast-moving and competitive market for 2024. Omnia looks at how the previous year ended within e-commerce and what industry players and shoppers may expect in 2024, in addition to the innovation that might change the future of retail. Social commerce will show its teeth Within the e-commerce landscape, it was the expansion of social commerce that made the largest leaps and bounds, proving once again how it has become the largest growing sub-industry within retail and e-commerce with an expected value of $2 trillion in 2025. Forbes predicted that social commerce is growing three times faster than e-commerce while the moves and counter-moves made in 2023 mirrored why: Meta and TikTok are not interested in your lunch selfies anymore. They’re interested in your likelihood to shop. With Meta’s new partnership with Amazon, allowing Facebook and Instagram users to shop Amazon ads directly in the app, a new era of e-commerce is forming that further increases Amazon’s control of the market and further drives Meta’s plans to create shopping-first platforms. Other social commerce companies such as TikTok, which is owned by Tencent in China, will also be focusing on establishing itself as a legitimate e-commerce and influencer marketing platform in the West. TikTok Shop’s launch in the US in September is set to disrupt both the social commerce and marketplace arenas for 2024. TikTok and Instagram are each other’s biggest competitors, thickening the hunt for consumer attention and loyalty. Instagram and Facebook are still the world’s top choices over TikTok for buying products, however, the difference is incremental: In Germany, 46% of shoppers use Instagram while 42% use TikTok. In the US, it’s 42% and 40% respectively, and in the UK, TikTok surpasses Instagram as the platform of choice (39% vs 35%). Despite TikTok’s incredible growth and influence, Omnia predicts that Meta’s new Amazon deal will keep them out of the top position for the foreseeable future. The Implications of TikTok's Ban on E-commerce Retailers The potential ban of TikTok in the United States carries significant ramifications for e-commerce retailers, who have increasingly leveraged the platform for marketing, sales, and customer engagement. TikTok, known for its highly engaging short-form videos and robust algorithm, has become a powerful tool for brands seeking to reach a young, tech-savvy audience. Here’s an exploration of the key implications: Loss of a Major Marketing Channel TikTok as a Marketing Powerhouse: With over 1 billion monthly active users worldwide, TikTok has emerged as a crucial marketing channel for e-commerce brands. The platform's unique algorithm promotes content virally, often reaching millions of users organically. For many retailers, TikTok has been instrumental in driving brand awareness and engagement through influencer partnerships, user-generated content, and creative campaigns. Impact of the Ban: If TikTok were to be banned, e-commerce retailers would lose access to this vast audience. Brands that have heavily invested in building a presence on TikTok would need to shift their strategies quickly. This disruption could lead to a temporary decline in visibility and engagement, impacting sales and customer acquisition efforts. Shift to Alternative Platforms Exploring New Avenues: E-commerce retailers would likely diversify and redirect their marketing efforts to other social media platforms such as Instagram Reels, and YouTube Shorts. These platforms offer similar short-form video features, which can help brands maintain some continuity in their marketing strategies. Challenges and Opportunities: Transitioning to new platforms may require additional resources and time to build a comparable follower base and engagement level. However, this shift could also present an opportunity for brands to diversify their social media strategies and reduce dependency on a single platform. Impacts on Sales and Revenue Sales Generation via TikTok: TikTok's "Shop Now" buttons and seamless integration with e-commerce platforms have enabled direct purchases within the app, boosting sales for many retailers. Revenue Risks: The ban would disrupt the revenue stream, especially for brands that have seen substantial sales through TikTok. Retailers would need to find alternative methods to drive direct sales, such as enhancing their websites' shopping experiences or investing in other social commerce tools. Influence on Consumer Behaviour Consumer Habits: TikTok has influenced consumer behaviour by making shopping more interactive and engaging. The platform's algorithm personalises content based on user preferences, making it easier for brands to target potential customers effectively. Behavioural Shifts: Without TikTok, consumers might shift their attention to other platforms, altering the dynamics of online shopping. Brands will need to adapt their strategies to align with changing consumer behaviours and preferences. Talk to one of our consultants about dynamic pricing. Contact us Talk to one of our consultants about dynamic pricing. AI and E-commerce in 2024 Artificial Intelligence (AI) is transforming e-commerce in various ways, and many technologies that retailers use daily are AI-driven, even if not immediately apparent. Here are six of the most common AI applications in e-commerce: Personalised Product Recommendations: Collecting and processing customer data about their online shopping habits is now easier than ever. Retailers rely on machine learning to capture data, analyse it, and use it to deliver personalised experiences, implement marketing campaigns, optimise pricing, and generate customer insights. Over time, machine learning will require less involvement from data scientists for everyday applications in e-commerce companies. Retail analyst Natalie Berg shares: ‘’AI is going to make retailers smarter leaner more efficient. And it's going to make our experience as customers as you can tell. It's going to make it more personalized more relevant’’ Customer Segmentation Access to more business and customer data, along with increased processing power, enables e-commerce operators to better understand their customers and identify new trends. Smart Logistics Machine learning's predictive powers shine in logistics, helping to forecast transit times, demand levels, and shipment delays. Smart logistics use real-time information from sensors, RFID tags, and similar technologies for inventory management and better demand forecasting. Over time, machine learning systems become smarter, building better predictions for supply chain and logistics functions. Sales and Demand Forecasting Especially in times after COVID-19, planning inventory based on real-time and historical data is crucial. AI can help with this. A recent McKinsey report suggests that investment in real-time customer analytics will continue to be important for monitoring and reacting to shifts in consumer demand, which can be harnessed for price optimisation or targeted marketing. These applications highlight how AI is revolutionising e-commerce, providing enhanced personalisation, operational efficiency, and smarter business strategies. Marketplaces will face stiffer competition with less market share Niche marketplaces within luxury such as Yoox Net-A-Porter (YNAP), Farfetch and Matches almost ended in collapse in 2023, however, Farfetch was saved by South Korea’s e-commerce giant Coupang in a last-minute sale, Matches has been purchased by UK retailer Frasers for €60 million, while YNAP is still searching for a saviour to bring them into the black since the sale to Farfetch fell through. According to Vogue Business, Amazon or Alibaba could potentially purchase YNAP, two of the world’s biggest e-commerce platforms, further strengthening their grasp on the marketplace landscape. As mentioned above, Amazon has continued its growth and consolidation by entering the social commerce space with Meta, which was announced in November, and the results of this deal will play out interestingly throughout 2024. How will this affect other marketplaces? In 2024, marketplaces will feel the pinch of the Meta-Amazon coalition as an increasing number of lucrative vendors will turn toward Meta platforms to make sales and grow their brands. As a result, consumers will go where there is variety with a competitive price and an easier shopping experience. However, if more shoppers will be heading toward Meta platforms, marketplaces may be able to take advantage of the increased traffic with new advertising, sales and pricing strategies. Marketplaces other than Amazon will need to incentivise shoppers to choose their platform - whether it is via social media or not - to remain profitable. Although Zalando ended off 2023 with declined quarterly sales, their new partnership with Highsnobiety has led Omnia to believe that they too have noticed the e-commerce success that lies within content. Europe’s largest marketplace has realised that many customers, especially Gen Z and millennial shoppers, buy into content and not products. The new platform, entitled Stories, creates fashion-related video content and provides news of collaborations and interviews with designers. “We know that customers are looking for inspiration and with Stories on Zalando we are doing exactly that: crafting highly engaging formats to show what’s new and what’s next in fashion,” says Zalando’s Senior Vice-President of Product Design Anne Pascual. Brands will restrategise marketing and sales strategies to regain sales Brands in multiple categories, especially in fashion, beauty and luxury, experienced a cooling period in 2023 that lasted longer than expected. For some, this will extend into 2024: Burberry’s shares have dropped 15% after they reduced their profit outlook thanks to a quieter-than-expected sales period over Christmas. Nike is cutting jobs and is set to reduce $2 billion in costs over the next three years amid dwindling sales. Gucci’s brand equity dropped 31% from 2022 to 2023, while L’Oréal and Lancome list 20% and 19% respectively. Overall, the annual Kantar BrandZ report concluded that the world’s top 100 brands lost 20% of their value in 2023, leaving them on the back foot as 2024 gets underway which will see brands moving and shaking to get into a profitable, growthful place again. Despite the overall lookout, other brands in some verticals including sports apparel and performance footwear did well such as Swiss-owned running shoe maker On which saw third-quarter sales increase by 44% and HOKA, which consistently saw growth throughout 2023 and gained in market share. In 2024, On is focusing on building its D2C channel which will cut into market share controlled by Adidas and Nike which have seen declining market share at Dick’s Sporting Goods, one of the US’s largest shoe retailers, while On and HOKA increase. Source: Reuters 2024 trends in sports apparel include a transition from logo-heavy designs, which we saw gain prevalence within “quiet luxury”, to “quiet outdoors”. Brands like North Face and Arc'teryx will be focusing on gaining the attention of luxury buyers who want in on sportswear with a high-end feel. Conclusion As we move into the second half of 2024, the e-commerce landscape is set to become even more dynamic and competitive. The developments in 2023, including the rapid expansion of social commerce, strategic partnerships, and the resurgence of influencer marketing, have laid a robust foundation for the coming months. Social commerce, driven by giants like Meta and TikTok, will continue to evolve, with new features and integrations aimed at enhancing the shopping experience. Meta's partnership with Amazon and TikTok's efforts to solidify its position as a key e-commerce player will significantly shape consumer behaviour and market dynamics. However, the potential ban of TikTok in the US could disrupt these trends, forcing brands to adapt quickly. Marketplaces will face increased competition as the Meta-Amazon coalition draws more vendors and consumers to their platforms. This shift will compel other marketplaces to innovate and offer unique incentives to retain their market share. Strategic partnerships, such as Zalando's collaboration with Highsnobiety, highlight the importance of content-driven commerce in attracting and engaging younger audiences. Brands, particularly those in fashion, beauty, and luxury, will need to re-strategise their marketing and sales approaches to recover from the prolonged cooling period of 2023. While some brands face continued challenges, others in niches like sports apparel are poised for growth, leveraging direct-to-consumer channels and tapping into emerging trends like "quiet outdoors." In summary, e-commerce in the second half of 2024 will be characterised by rapid adaptation, and a focus on personalised, content-rich consumer experiences. Brands will need to leverage strategic partnerships with influential platforms and content creators to stay relevant. The successful players will be those who can seamlessly integrate innovative technologies and data-driven insights to create engaging, tailored shopping journeys for their customers.

The Future of Retail: Navigating E-commerce Trends and Innovations in 2024

26.12.2023

Sustainability: Footwear gains traction in creating a circular economy

Reincarnating the shoe - that’s what some global brands in footwear are attempting to do with sustainability’s latest solution to a mounting climate change problem. A circular economy refers to an ecosystem where...

Reincarnating the shoe - that’s what some global brands in footwear are attempting to do with sustainability’s latest solution to a mounting climate change problem. A circular economy refers to an ecosystem where fashion is designed with its end-of-life state being top-of-mind. Circular fashion and footwear are designed specifically to be recycled into new items made from the old. From the individual fibres of a t-shirt to the type of glue that binds shoe parts together, circular fashion is dedicated to reimagining how garments are made to avoid deeper damage to the planet and its resources. Up to 92 million tonnes of clothing and footwear end up in landfills around the globe each year, making the fashion industry one of the most significant contributors to waste and carbon dioxide emissions. “Circular fashion is a closed-loop system that aims to design out waste,” states the Sustainable Fashion Forum. Europe’s share of footwear consumption in 2022 sat at 14.9% of the global total, equaling 3.58 billion shoe purchases across the continent, and of those shoe purchases, how many can we say once had a life in another home on another foot as another shoe? As circularity initiatives grow for clothing and accessories through resale marketplaces and brand-run programs, shoes have been largely left behind. However, 2023 saw a positive uptick in footwear brands who want to see their shoes live several lives. Omnia delves into why it’s so difficult for shoe brands to create circularity and who’s doing it right. Why it’s harder for shoe brands to create circularity vs clothing It may be harder, but it’s still possible, and brands are proving it. Footwear is generally made to last longer than clothing, especially in the sports and outdoor aisle, with plastic, rubber and leather used for most shoe products. National Geographic reports that 47% of all footwear is made of plastic and rubber, making the 23.9 billion shoes produced globally in 2022 one of the most sustainably challenged products in retail and textile production. Clothing, on the other hand, is a much simpler item to create a circular ecosystem with, as items usually involve one to two materials. “Footwear has up to 200 different parts that go into one shoe,” says Adidas’ Senior Director of Sustainability Viviane Gut. Because of this, some global fashion companies have made concerted efforts to install circularity initiatives including H&M’s goal to become completely circular by 2030 by utilising 100% recycled and sustainability-sourced materials. There’s Farfetch, the UK-based marketplace for pre-owned luxury fashion and accessories, whose second-quarter results for 2023 showed 4.1 million active shoppers and a 40% year-on-year increase in supply growth. In essence, creating a more sustainable t-shirt or reselling a used blazer is less expensive and more seamless than going back to the drawing board of recreating how the shoe is made. However, this doesn’t mean it isn’t being done: In November, the Business of Fashion reported that eight global brands including New Balance, Crocs, Target, Brooks Running, Reformation, Ecco, Vibram and On are banding together under the name The Footwear Collective to share knowledge and resources to expand the circular shoe economy, which is the first of its kind within the shoe market. In addition, Nike debuted its first circular shoe in August 2023 entitled ISPA Link Axis. As the world’s largest sneaker producer, Nike calculated their carbon footprint to be over 11.7 million metric tonnes of CO2 in 2020 alone, equating this impact to what the entire city of Amsterdam, Netherlands may offset in the same period, further proving how necessary it is for global brands to create circularity and end-to-end sustainability. Each component of the shoe is made from recycled materials and no glue, making it the ideal shoe to be disassembled and reinvented once more. Assembling the Link Axis is also more energy efficient, as it does not require time and resources to glue the sole to the upper parts of the sneaker. Nike ISPA Link Axis Talk to one of our consultants about dynamic pricing. Contact us Talk to one of our consultants about dynamic pricing. Where does the circular economy begin? Creating a closed-loop ecosystem where garments essentially never become waste is central to a circular economy. However, at the heart of the conversation, the first question brand leaders and retail entrepreneurs can ask themselves is, if we can’t rely on consumers to resell our garments or take part in branded circular initiatives, how do we kickstart circularity from the inside out? How do we at least guarantee that our manufacturing and production practices are low-impact? Allbirds, the shoe brand that’s made a name for itself for its innovation in sustainability and carbon offsetting, has already done more than most to create a greener product when they launched a sneaker in 2015 made out of Merino wool from sustainable farming and recycling. The sneaker’s fame came from the fact that it only had a small carbon footprint of 9.9 kilograms, however, this success only motivated Allbirds to go further. In mid-2023, the brand launched a new sneaker at the Global Fashion Summit in Copenhagen that offsets 0.0 kilograms of carbon dioxide, making it one of the first sneakers to be carbon neutral. For Allbirds, this is all part of their long-term goal of reaching a 50% reduction in their carbon footprint by 2025, culminating in a 0% carbon footprint by 2030. Allbirds The Moonshot In essence, circularity needs to start at the root including materials, manufacturing, transportation, product use, and end-of-life which may include the resale market, return initiatives, brand-run programs, and recycling. New rules for the new world The very first shoe, created approximately 9,000 years ago and discovered in California, USA, was made out of sagebrush bark that simply covered the toes and the sole. Today, the sophistication and variety of footwear are evident from Prada to Nike to Timberland and everything in between. As fashion and footwear brands continue to release new items in the coming decades and centuries, one thing is for certain: The rules for producing, manufacturing and discarding will change. Policy, public scrutiny and changing consumer behaviour will edge and direct brands to revisit their production, distribution and end-of-life methods time and time again to ensure greener products are the end result. Creating and taking part in a circular economy for shoes and fashion is one of the best solutions for brands and consumers to lower their carbon footprint, reduce landfill accumulation and make full use of the materials used. “When you use materials seven, eight, or 10 times over, then the footprint goes down dramatically,” said On’s co-founder Caspar Coppetti to the Business of Fashion, the Swiss shoe brand that’s been backed by Roger Federer. “You have to really go to the source and develop new processes, new technologies, scale them … and then there’s a lot more investment needed.”

Sustainability: Footwear gains traction in creating a circular economy

14.12.2023

Black Friday sales increase, but holiday spending looks shaky

Consumers showed their resilience once more for Black Friday 2023 amid global economic turmoil as sales increased across multiple channels, categories and markets. Shopify and Adobe all shared positive year-on-year...

Consumers showed their resilience once more for Black Friday 2023 amid global economic turmoil as sales increased across multiple channels, categories and markets. Shopify and Adobe all shared positive year-on-year increases: Shopify reported a 22% increase in sales from brands using its platform while Adobe Analytics shared a 7.7% increase in e-commerce sales over the total Black Friday weekend. In addition, year-on-year foot traffic for brick-and-mortar stores also saw an increase, albeit a small one, of 1.5% on Black Friday weekend. Adobe’s annual report, which covers 100 million SKUs in 18 retail categories, found five categories to be the largest contributors to this year’s sales - clothing, electronics, furniture, toys and groceries. These contributed to 60% of the €101 billion in sales from 1 - 27 November, which includes pre-Black Friday discounts during the month. By the end of the shopping weekend, discounts climaxed at 31% for electronics, 27% for toys, 23% on apparel and 21% on furniture. Small appliances and electronics like TVs and smartwatches also did particularly well while beauty and personal care saw Black Friday and Cyber Monday sales for beauty saw a 13.3% increase in year-on-year sales, as reported by RetailNext. Performance footwear’s discounts led to high sales Brooks Running was one of the performance shoe brands that reported a highly successful Black Friday/Cyber Monday period, enjoying a 14% record boost in sales on Cyber Monday alone. Omnia researched Dutch pricing data for running shoes to see what could have caused the increase in sales. Black Friday and Cyber Monday offers already began the Friday beforehand but the number of offers increased over time with the peak on Black Friday. Discount offers remain over the weekend and return to lower levels two days after Cyber Monday. Compared to the month before, Black Friday and Cyber Monday are seen as highly competitive days. On selected items, there is an average discount of 18.5%. Where some retailers and brands even go up to a discount of 28.7% on average. During this period we see different strategies of different retailers coming to life. Where some retailers and brands rely more on heavily promoted products, others that maintain their competitive strategies aren't able to discount that much. A trend we detect in the running shoe business is that brands, on average, have higher discounts, showcasing that a D2C strategy could be highly lucrative over this period. What can retailers expect about festive season spending? The state of consumer spending over Black Friday weekend should not fool retail leaders. Stubborn inflation and high food and gas prices are very much a constant monkey on the shoulders of household budgets and, even for wealthier consumers, have eaten into expendable income. Adobe reported a 14% increase in buy-now-pay-later services compared to this period last year. Cyber Monday saw a massive 42% increase in the use of these services as consumers moved to act resourcefully to make purchases. In addition, US credit card debt exceeded $1 trillion in November. Overall, although Black Friday spending was better than expected, a booming holiday shopping season will likely not be on the cards. Retailers and brands expect to see year-on-year increases, but it won’t be because of the usual holiday shopping explosion: Inflation has resulted in all-round price increases, making everything more expensive than last year, resulting in consumers spending more money for the same or less. Single-digit increases in spending of 3 - 4% are predicted, according to the US National Retail Federation, in comparison to 2021’s 12.7%. Average selling price across all categories: 2022 vs 2023: Source: Salesforce data published by Forbes Consumers expect to spend, but this will be largely due to the fact that consumers feel obliged to buy gifts over this period, and not because they want to go all-out on multiple gifts, holidays and treats for themselves. “They’ve been very resilient. They will shop. They have obligations to family and other loved ones that they’re going to fulfil the gift list for," says Michael Brown, a partner at Kearney. In the UK, festive season shopping, which encompasses both November and December, has not started as strong as in previous years: The British Retail Consortium and KPMG report that retail sales in November totalled 2.7% compared to 4.5% in 2022 while non-food items experienced a decline altogether. Moreso, PwC predicts a 13% decline in festive season shopping in the UK market, as reported by the Business of Fashion. As a result, UK retailers are expected to discount heavily in January 2024 to offset sitting stock that should’ve sold during this year’s fourth quarter. How can retailers make the most of December deals? McKinsey suggests that providing value will likely be the best strategy for retailers and brands to get consumers to shop which could mean offering same-day delivery, free shipping, product bundles, or sharper discounts. “People are heading into the new year thinking inflation is bad, interest rates are tough, there’s geopolitical conflict in the world, and that’s why consumers are so negative. They’re in betwixt, and their uncertainty is what’s keeping them from splurging,” said Kelsey Robinson, senior partner at McKinsey. In terms of sales channels, smartphone shopping for e-commerce sales accounted for a 54% majority, meaning an advertising restructure targeting smartphones via social commerce may result in higher sales. Targeting social commerce buyers may also lead to an entirely new stream of customers for future purchases.

Black Friday sales increase, but holiday spending looks shaky

24.11.2023

Amazon and Meta's 2023 partnership share a common end-goal

Jeff Bezos and Mark Zuckerberg are smiling a little more as the fourth quarter of 2023 plays out, thanks to a striking new deal between Amazon and Meta: Instagram and Facebook users can now shop products directly from...

Jeff Bezos and Mark Zuckerberg are smiling a little more as the fourth quarter of 2023 plays out, thanks to a striking new deal between Amazon and Meta: Instagram and Facebook users can now shop products directly from Amazon ads in their feed without having to exit the app. Shoppers will have the ability to link their two Amazon and Meta accounts “for a more seamless shopping experience,” says Meta in a statement in November. “For the first time, customers will be able to shop Amazon’s Facebook and Instagram ads and check out with Amazon,” said the company too in a statement. Source: Maurice Rahmey, Co-Founder and Co-CEO at Disruptive Digital As retail and e-commerce experience decreasing sales, small businesses and enterprises will be looking at this new partnership intently to see how it may affect their sales strategy. Despite the possibility of some good news for brands and retailers, who may be eager about the news of this collaboration, Omnia sees other factors that may be at play: Is it more about increasing ad sales and consolidating advertising market power, or is it about the end seller? Setting the stage for the Amazon-Meta partnership Over the years, social commerce has matured to rival e-commerce in its sales and reach. The line between a successful e-commerce marketplace or retailer and an in-app storefront on social media is blurring, and no other example than TikTok Shop’s launch in the US in September displays this phenomenon so well. However, despite social commerce’s rise to success with a valuation of $1.2 trillion by 2025, the industry’s largest player, Meta, has still struggled to rebound after Apple’s iOS privacy updates in 2021 largely cut off its ability to mass target customers and collect data from them. Forbes wrote in 2022 that Facebook took a $12 billion knock to ad revenue after the change. As a response, Facebook and Instagram simultaneously increased advertising costs for brands and retailers and squeezed their reach and engagement levels to initiate more ad spending, which created an unprecedented scenario for themselves where advertisers chose other platforms to advertise on. When it comes to Amazon, as it has grown bigger and more brands have chosen to sell their products on the behemoth marketplace, the more saturated each category has become. And as brands - big and small - obviously want to be seen by shoppers on Amazon’s apps, the competition for attention thickens, making for a ripe scene for Amazon to take advantage of this competition. Getting vendors to advertise their products has been the e-commerce giant’s strategy for some time now, with the push to lure in ad expenditure from sellers accruing $12.06 billion at the end of the third quarter. That’s a 26% increase compared to the same time in 2022. Looking ahead, Amazon has ramped up their agenda to boost ad sales, offering enterprise ad agencies the chance to advertise via Amazon Prime Video in 2024, asking for between $50 - 100 million. It may seem out of left field for a retail company to focus so much on building an advertising department, however, this is how Amazon plans to consolidate growth and power in the industry. Talk to one of our consultants about dynamic pricing. Contact us Talk to one of our consultants about dynamic pricing. How will this affect brands, enterprises and other marketplaces? There are pros and cons to this deal that will have ripple effects. For brands who already sell on Amazon wanting to increase sales volume, being able to advertise and convert directly within Facebook and Instagram will be largely beneficial to them. The ease of the process will also be improve the customer’s shopping experience and, in turn, will build a network of return customers. For enterprises, the pros are quite similar, however, a glaring con is that larger enterprises also want to direct traffic to and sales from their own websites using their own pricing strategies that aren’t dictated by Amazon. The Amazon-Meta partnership may send enterprises down a path where they see less sales from their own platforms and find themselves relying more on in-app sales from their Amazon stock. If this takes place, Amazon will be able to indirectly control the price of an enterprise’s product. For marketplaces, especially those in niche categories, this partnership may leave them out in the cold. As the Amazon-Meta coalition grows, more and more vendors will turn toward it to make sales and grow their brand. In turn, more shoppers will go where there is variety with a competitive price and an easier shopping experience. As a result, other marketplaces may feel the effects of consolidation by losing vendors, shoppers and overall sales. A new era within e-commerce This is a surprising partnership for the e-commerce industry and is being described as “the most significant ad product of the year” by Founder and CEO of Disruptive Digital marketing agency Maurice Rahmey. When speaking to CNBC, Rahmey said the partnership shows “these two-walled gardens are kind of coming together.” According to a Duetche Bank report quoted by Fast Company, 75% of Facebook’s billions in revenue comes from small businesses, making Facebook (and Google) the chosen place for small-to-medium businesses to advertise and sell. If Meta has done such a good job in cornering the SMB market, it’s no surprise that Amazon would want in. And if Amazon has done well to expand profits through ad sales, it’s no wonder Meta would want a chance to recover from their $12 billion knock from Apple’s iOS privacy changes. However, these may be short-term goals for the two companies, and it’s all about the long game for both of them: For Meta, this unlikely partnership is a giant leap towards increased ad sales and market penetration through social commerce. For Meta, this collaboration means forging towards a commerce-first platform, beyond the early years of selfies and poking. Combining their resources on tracking, data and user experience, a new era of shopping and marketplace expansion is upon us.

Amazon and Meta's 2023 partnership share a common end-goal

14.11.2023

TikTok Shop: What’s in store for marketplaces with the new e-commerce platform?

The end of the third quarter of 2023 saw TikTok launch its new Shop tab in the US market, adding to an already unpredictable and fast-moving marketplace arena. While it may be too early to place its seat in the market,...

The end of the third quarter of 2023 saw TikTok launch its new Shop tab in the US market, adding to an already unpredictable and fast-moving marketplace arena. While it may be too early to place its seat in the market, TikTok Shop brings all kinds of possible scenarios and questions: How will this affect Amazon and other large marketplaces? How will consumers approach shopping on this new platform? How will this impact the current social commerce playground? Social commerce is set to grow faster than e-commerce in the coming years, with an expected annual growth rate of 32% from 2023 - 2030, creating a landscape that increases the competition for marketplaces such as Amazon, eBay and bol.com. Omnia unfolds how TikTok Shop will play out for brands and retailers looking to focus their energy and budgets on social media. Consumers will buy into content, not products, on TikTok Shop The virality of TikTok content has shown how the intertwining of content and shopping results in sales, profit and brand awareness. TikTok Shop’s marketplace will be relying heavily on a content-first strategy to influence buying behaviour, which will essentially replicate its already highly successful and addictive video content section that saw unexpected brands, especially in beauty, reach new heights when influencers, bloggers or ordinary app users include a shop link to a product. What TikTok seems to get right is that it centers shareability more than its rival social commerce platforms, making app users (and potential shoppers) more likely to want to get in on the trend - whatever that trend may be at any given time. According to HubSpot, 77% of TikTok users prefer it when a brand creates content around challenges, trends or memes, encouraging people to join. But more than that, brands with little to no advertising presence on TikTok are finding success simply because creators are using, posting and tagging product links. As the Business of Fashion states, “TikTok has become a beauty shopper’s playground.” For example, the hashtag #snailmucin has 776 million views (at the time of writing), which has helped COSRX’s snail mucin serum reach global corners. Content will be king in TikTok Shop’s success, however, in the short term, we do not see them overtaking as e-commerce’s new behemoth. This does not mean that marketplaces should not be wary of the growth trajectory of social commerce platforms: Social commerce will account for 50% of US e-commerce sales by 2027. TikTok Shop may replace Instagram as the leading social commerce platform The age of influencers on social media reached a stale point, in the last three years, since the height of the Covid-19 pandemic in 2020, as consumers faced loss and tragedy on a grand scale. However, as cycles go, consumers have rebounded from contemplating the meaning of life and the urge to shop, travel and look their best has returned with gusto in 2023, despite inflation. For brands and retailers, this is good news: The age of influencers is back, and this time it’s not on Instagram. Source: IMF World Economic Outlook 2023. In the above graph we see how influencer marketing drastically dipped from 2021 - 2023 but plans to rebound in 2024 and onwards. The more interesting observation is how influencer marketing plans to remain stronger than social ad spending, which bodes well for TikTok Shop influencers going forward. Moreover, TikTok Shop’s e-commerce viability is even stronger than some may think: Although Meta platforms have been at it for longer, Instagram’s removal of their Shop tab in January as well as the withdrawal of in-app product links for influencers means that editorialised product virality has moved away from Instagram and more towards TikTok Shop’s corner. In addition to Instagram removing its Shop tab, the platform is also much stricter on - if not altogether against - independent vendors that may fall into the grey market. On TikTok Shop, however, independent sellers and influencers can revel in a much more lenient, open-air system that focuses more on sales than it does on legitimacy. Additionally, with adult social media users spending more time, on average, on TikTok (54 minutes per day) than Instagram (33 minutes), Omnia is curious to witness how consumers and social media users will approach each platform, especially considering the differences in how each platform tackles shopping. According to Insider Intelligence, TikTok Shop will have just over 33 million buyers in the US in 2023 alone just after its September launch. Even though this is lower than Facebook (65 million in 2023), the percentage of shoppers on each platform is equal at 37%, making TikTok the faster-growing e-commerce choice for shoppers. Talk to one of our consultants about dynamic pricing. Contact us Talk to one of our consultants about dynamic pricing. Early hiccups include fake products and an unrefined algorithm However, it is not all sunshine and roses for TikTok Shop, as a large number of products on the platform seem to be low-quality goods from China. Bloomberg News, through a look at the Shop tab’s listings, found that many of the goods that are “recommended” by the app are outdated and irrelevant such as waist trainer vests, or simply a random choice of items from mini clay statues to budget planners, akin to what shoppers would see at a garage sale. Other issues include products that are counterfeited such as fake Nike sweaters and skincare products from Korean brand COSRX that are heavily and suspiciously underpriced and labelled as being made in China while the brand is well known for being produced in Korea. In this early stage of the marketplace’s launch in the US market, it is crucial for the algorithm that creates a user’s particular interests to impress and lead to conversions, especially since TikTok’s parent company, ByteDance, has set its eyes on selling $20 billion worth of merchandise in the next year. This rivals Amazon’s target for the US market too, however, what TikTok should try to avoid with their new shopping platform is the disorganised and unvetted flea market style that this early version of TikTok Shop is currently presenting to some users which is reminiscent of eBay’s and Amazon’s earlier days of jam-packed categories and sub-categories of vendors. In addition, some luxury and established brands within fashion and beauty are hesitant to jump into the TikTok tide, fearing brand depreciation due to the association of possible counterfeiters, leaving TikTok on the outskirts of a lucrative revenue stream. A volatile start with pros and cons In 2022, as a content-creating-specific platform, TikTok still outweighed Instagram (16.4%) and YouTube (17%) as the number one destination for shopping on social commerce, with 21% of consumers who use social media to shop selecting TikTok. As the platform improves and bolsters its shopping features, that number is only set to rise. Regarding the platform’s algorithm issues and reliability as a trusted marketplace with vetted sellers, ByteDance may experience setbacks in the US market. Policymakers remain concerned that consumer data is at risk of being misappropriated via Chinese vendors. TikTok Shop will have to work harder to onboard American vendors located within the US to avoid legal ramifications as well as a deterioration of trust among shoppers. Marketplace market share still resides in the hands of the larger marketplaces, but this we already know - what we don’t know and will anticipate learning is how consumers react to this developing channel of shopping, and what the long-term arc of TikTok Shop will be as e-commerce leaders fight for growth and market share.

TikTok Shop: What’s in store for marketplaces with the new e-commerce platform?

22.09.2023

What quiet luxury tells retailers about consumer sentiment

A new trend in high-end fashion has emerged that speaks of a new era in how the ultra-wealthy convey their identity: Quiet luxury. Breaking from the days of loud logo-boasting in the early and mid-2000s, quiet luxury...